Reading time 4 minutes. Use our table of content for a quick read.

Reading time 4 minutes. Use our table of content for a quick read.

Last Updated on 18/07/2023 by STEPHANE

Automatic translation from Google translate:

The long-term search for an equilibrium on the Spanish rental market

We will not refer to tourist rentals or seasonal rentals -which will also be the subject of an article later- but we will talk in this paper only about “classic” rentals that constitute the homes of families. When we analyze the situation: it is so difficult to find a balanced solution that pleases all the players.

We have spent decades with a Law of Urban Leases that protected the tenants in such a way, that there were cases in which a 300m2 apartment on the Diagonal was enjoyed for 600 “constant” Pesetas ( about € 4 today) until the death of the tenant and beyond… if there were relatives living with the deceased. I remember desperate owners, forced to change the elevator, and whose rental income did not even cover maintenance.

Then came the ‘Decree Boyer’ in 1985, and thereafter the new law in 1994, and market rents of flats became a sort of ‘Far West’, for which the new tenants had to face free prices, meagre stays and the consequent pressures before the time of renewal.

It is clear that this situation, in years of economic boom, decisively favoured the real estate market, with mortgage loans that today constitute a headache we are experiencing.

But here we are: we do not know how to find the middle term of things, letting the law of the pendulum act like an elephant in a china shop.

Other solutions in foreign countries like Germany, Austria and Switzerland

Those of us who have seen a little of what goes on outside, find with astonishment that, for example, in Germany, Austria and Switzerland, it is only a minor part of the population that owns its housing: the wealthiest, owning something exclusive properties. Most of the population lives in flats or terraced houses whose owners are investment funds or pension funds.

If the housing ceases to be a speculative good (it seems that this is not going to be the case since there is already talk of another bubble) there would be security for the stability of the housing market. Which would avoid the distortions of unpayable mortgages we have been living in recent years.

Lately, we have seen significant increases in rents, where Barcelona and Madrid have marked record highs, so we find that former owners with unpayable mortgages are in a rental market with unpayable leases, however, at the same time, we have about 3.5 million empty homes.

A new system in Catalonia?

The Catalan government tried to impose a tax on vacant dwellings, which has been suspended by the Constitutional Court. They are now trying, together with the Barcelona City Council, to reduce abusive rents through tax credits and aid to landlords who fix more modest prices. Another measure welcomed by the Catalan government is a new price index that would be applied gradually and for which, in June 2017, 27 municipalities had been taken into account, representing almost 60% of the population of Catalonia.

It is a pioneering system in Spain that is inspired by the one that has ruled Berlin for years. According to the Generalitat itself, it is an indicator of public consultation with an informative nature that allows us to know an estimate of the average price per square meter of rent for a house located in an area and with characteristics defined by the person making the query. You can find more at the following link.

The important thing is that the rates are considered fair by both the tenants and the owners, a difficult task, as each one looks at the proposed house with its own glasses. And, unlike Germany and Austria, in which the majority of rental housing is from large specialised corporations, in Spain 97% of rental housing is in private hands, according to data from Solvia, which implies more diversity of opinions. Recently I wrote about the big projects planned by large corporations that may be interested in entering this dynamic, which would settle that percentage a bit, find the earlier paper here: The new “Phoenix”: the construction of homes reborns with force in Spain.

In our opinion, a stabilisation of the housing market would provide advantages for homeowners concerning the regularity of the leases’ payments and possibly a more accessible rental market for the tenants.

If this stabilisation can sometimes mean some sacrifice concerning income, this may be offset in the long run by this regularity, as there is nothing worse than a slope housing rented for months, and especially it should be complemented by tax credits and aid.

This system could even come to reduce the need to invest in social housing, so the paradox that aid might end bonuses and might mean savings for the Spanish state.

This article is written by one of our independent partners in Spain, Juan, who is one of our Legal partners in Catalonia. Check his profile.

Looking for another real estate lawyer in another Spanish region?

Check the full HTBIS team here

Automatic translation from Google translate:

Property sold in Spain rose by 9.2% in December to 32.211 units.

The INE, the “Instituto nacional de Estadistica”, the Statistic office in Spain has released the last numbers for property transactions in December.

In December, the number of dwellings sold was 32.211 units:

Urban vs Rustic properties (including land)

- Urban properties 54.510 +6% vs last year

- Rustic properties 9.625 -5.5% vs last year

Newbuild vs existing

17.8% of properties sold in December are new and 82.2% are existing properties. If we compare that to December 2016, the growth in transactions for newbuild is 11% and is 8.8% for existing properties.

Protected vs not protected

- Protected housing sold were 10.3% vs 89.7% for not protected.

- That is a growth of 16.5% for protected and 8.4% for free housing.

Top 3 Autonomous Communities

- Andalusia, 6.287, +10.7%

- Valencian Community, 4.980, +25.5%

- Catalonia, 4.749, -5.7%

- Community of Madrid, 4.721, +10.2%

Biggest growth

- Castilla la Mancha +44.4% (1.343)

- Aragon +32.5% (979)

- Principalty of Asturias +31% (600)

- Valencian Community +25.5% (4.980)

Negative growth

- La Rioja, -17.5%, (188)

- Balears, -8.3% (1083)

- Catalonia, -5.7% (4.749)

- Basque Country, -5.4% (1.128)

Review of the property transactions in Spain for the year 2017

1.787.776 Transactions in 2017 vs 1.687.700 in 2016

- 933.104 properties sold in 2017 or a growth of 12.7% (vs a growth of 9.5% in 2016, 8.5% in 2015 and 1.6% in 2014)

- 464.423 dwellings sold in 2017 or a growth of 14.6% ( vs a growth of 14% in 2016, 11.5% in 2015 and 2% in 2014)

- 418.915 were free housing and 45.508 were protected

- 381.163 are existing housing while 83.260 are newbuild properties which

Top 4 Autonomous Communities in terms of the number of transactions for 2017

- Andalucia with 89.337 dwellings, +12.6%

- Catalonia with 76.369 dwellings, +13.6%

- Community of Madrid with 70.203 dwellings, +18.9%

- Valencian Community with 68.512 dwellings, +18.1%

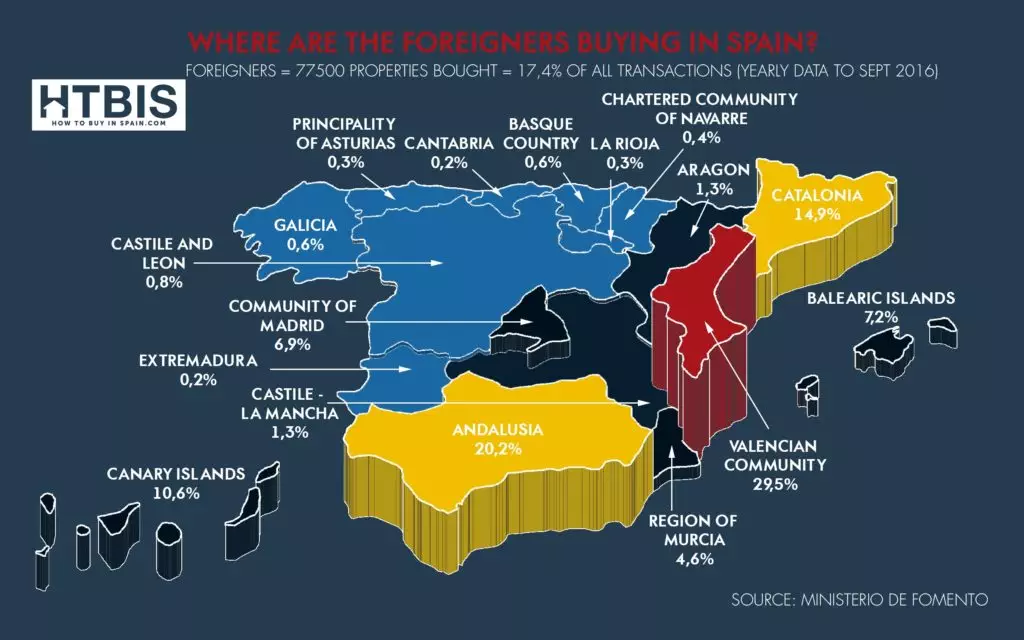

Have a look at our infographic on where the foreigners are buying real estate in Spain, the top regions are the same apart from Madrid.

Top 4 Autonomous Communities with the highest growth in 2017

- Castilla la Mancha, +24.7%, 16.693 dwellings

- Community of Madrid, +18.9%, 70.203 dwellings

- Valencian Community +18.1%, 68.512 dwellings

- Asurias +17.5%, 7537 dwellings

4 Autonomous Communities with the lowest growth in 2017

- Pais Vasco +5.4%

- Galicia +8.7%

- Extremadura +10%

If you want to compare Spanish prices vs European ones, have a look at our earlier article: What return have you made on your Spanish Property investment in 2017? And 2018?

Source: Find the press release in Spanish here

Looking for an expert in Spain? Ask us directly!