Reading time 5 minutes. Use our table of content for a quick read.

Reading time 5 minutes. Use our table of content for a quick read.

Last Updated on 11/07/2025 by STEPHANE

Click on any flag to get an automatic translation from Google translate. Some news could have an original translation here: News Nouvelles Nieuws Noticias Nachrichten

Congratulations, you found your Spanish dream property!

What is the cost of buying a property in Spain?

Article Overview: Get the essential information in 30 seconds, then dive deeper into any section that interests you.

Key Facts: Spanish Property Purchase Costs 2025

- New-Build Properties: 14% total costs as of 2025 (10% VAT plus 4% additional fees including registration and legal)

- Resale Properties: 10-14% total costs depending on region (6-10% transfer tax plus 1.5% registration plus legal fees)

- Regional Variations: Transfer tax rates vary from 6-10% across Spanish autonomous communities

- Currency Exchange: Up to 3% additional costs when converting from non-Euro currencies to pay for Spanish property (Ask us for better solutions)

- Agent Fees: Real estate agent commissions paid by seller, not buyer (standard practice in Spanish property market)

Expert Insights:

- Currency Optimization: Use specialized international money transfer companies to save up to 3% on currency exchange versus traditional banks, and lock exchange rates before completion

- ⚠️ Regional Tax Trap: Transfer tax varies dramatically by region (6% in Madrid vs 10% in Catalonia) – always verify local rates before budgeting as this can add thousands

- ⚖️ Legal Protection: Never skip independent legal representation despite the 1-2% cost – Spanish property law requires due diligence that can save you from costly title issues

- Banking Strategy: Open your Spanish bank account and obtain NIE number before house hunting to speed up purchase process and strengthen negotiation position

First question is:

- Is it a new-build property?

- Is it a resale?

Depending on your answer, the cost will be slightly different, but a good rule of thumb is 14%.

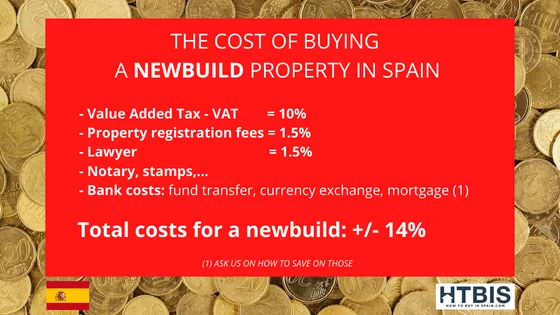

1. The cost of buying a New-build property in Spain: +/- 14%

- VAT =10%

- Property registration fees = 1.5%

- Lawyer between 1 and 2%:

- Other costs: Notary, stamps,…

The cost of buying a new build property in Spain

2. The cost of buying a Resale property in Spain will be between 10 and 14%

- Transfer Tax = 6 to 10% at the general tax rate (but you have reduced rates in some instances). This amount depends on which Spanish region this property is located.

- Property registration fees = 1.5%

- Lawyer between 1 and 2%

- Other costs: Notary, stamps,…

The cost of buying a resale property in Spain

Don’t miss What is the legal due diligence for your Spanish property?Do you need a property lawyer or a tax advisor to assist you in Spain? Find a Spanish property lawyer in our network.

3. Other costs to take into account

- Banking costs: Usually a percentage of the amount wired + cost of holding an account

- This could be very important if you don’t have a Euro account and need to convert your currency like Pound, Dollar, Yuan, Shekel, Ruble,… up to 3%

1. You can lock a currency level

=> You will know the commission BEFORE wiring the money

=> You will see the level at which you will convert your currency into Euros BEFORE wiring the money

=> You will know the exact amount you need to wire in your local currency BEFORE wiring the funds

2. You wire the money in your currency

3. The company will wire the money in Euros in Spain to your Spanish account (Don’t forget your NIE, read our earlier paper on that) , your lawyer account,…

- Mortgage costs:

- Bank valuation of the property = +/- 750€

- Mortgage deed = +/- 750€

If you want to check the monthly cost of your mortgage, or what is your purchasing power for a Spanish property, check our ultimate mortgage calculator!

Related: Your definitive guide to your Spanish mortgage. How to get the best rates?

Do you want to find the best Spanish mortgage rates? Fill this quick form and ask our partner for a quote.

- Real Estate agent fee: Here is the good news you were waiting for: the seller is paying this one 😉 In general.

Before buying, you want to know the annual cost of owning a property in Spain. Read our paper on this subject.

All that information is from reliable sources. We advise you to review these with your fiscal and legal advisors to ensure all costs are up to date and adjusted to your specific situation.

Is the cost of living in Spain higher than in your home country?

Please review our comprehensive article and study on the subject.

If you are living in the UK, here is our dedicated article: Cost of living in Spain vs UK.

Please have a look at our detailed property buyers guides, custom-made for any nationality.

Here are our FREE pdf property buyers’ guides written for all the foreign nationalities looking to buy in Spain: Click on your country flag, you will find your pdf report at the end of each article. Get most of our tips there.

Do you want to start searching immediately?

Discover the best new build projects in Spain available right now

Don’t know where to buy? Start with our general article: Everything you ever wanted to know about the top 20 Spanish real estate markets

Get your insights right to your mailbox? Register for our newsletter!

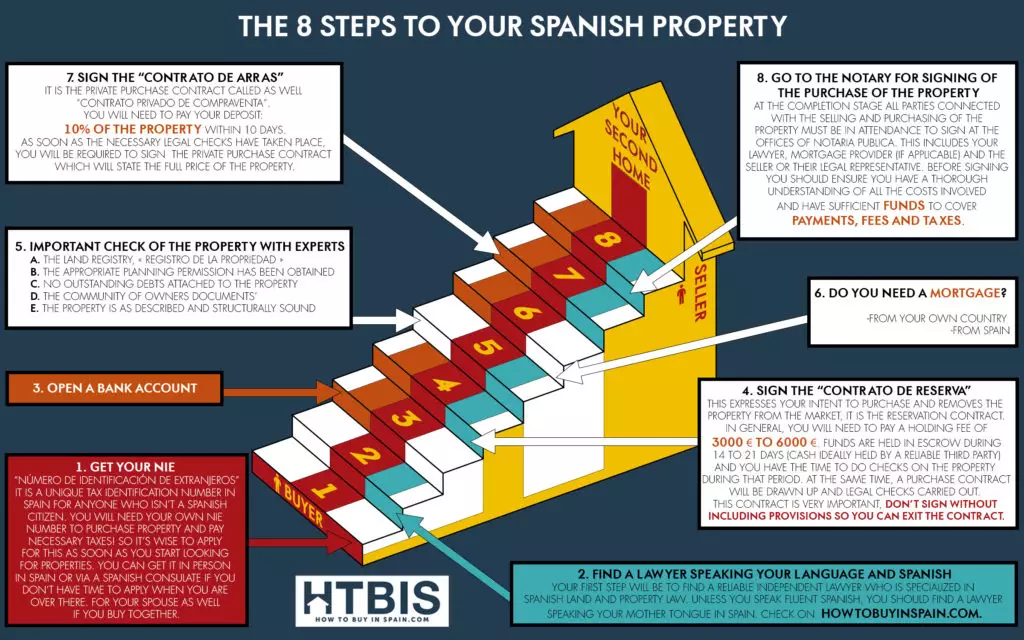

Finally, if you want more, check our handy infographic: The 9 legal steps to your Spanish property

Looking for a property lawyer in Spain? Follow the link and get one of our local lawyer.

Looking for another real estate expert in Spain: Mortgage, Insurance, Survey of property, Property hunting, …? Ask us directly one of our 100+ local partner!

Stéphane

Senior analyst and strategist at HTBIS

Stéphane, with over 20 years of experience in real estate, finance and entrepreneurship, is the co-founder of www.howtobuyinspain.com. With an extensive network of local partners in Spain, his deep commitment to the real estate sector, combined with strong analytical skills and a problem-solving mentality, has fueled his success. Constantly eager to learn and passionate about teaching, Stéphane believes in the power of knowledge sharing to master any subject.

Check the whole HTBIS team here.

Spanish Property Costs FAQ

What are the total costs of buying property in Spain?

The total cost of buying property in Spain ranges from 10-15% of the purchase price. New builds cost around 14% (including 10% VAT), while resale properties cost 10-14% depending on regional transfer tax rates.

What is the difference between new build and resale property costs?

New builds have 10% VAT plus 1.5% registration fees totaling ~14%. Resale properties have 6-10% transfer tax (varies by region) plus 1.5% registration fees, totaling 10-14% depending on location.

How much does a Spanish mortgage cost?

Spanish mortgage costs include bank valuation (~€750) and mortgage deed (~€750). Additional costs include legal fees (1-2% of property value) and potential currency exchange fees up to 3%.

Do I need a Spanish bank account to buy property?

Yes, you need a Spanish bank account to buy property in Spain. You'll need it for mortgage payments, taxes, utilities, and ongoing expenses. A NIE number is required to open the account.

What is the transfer tax rate in Spain?

Transfer tax rates vary by Spanish region, ranging from 6-10% of the property value. This applies only to resale properties, not new builds which pay 10% VAT instead.

How much do currency exchange costs add to property purchases?

Currency exchange costs can add up to 3% when converting from non-Euro currencies. Using specialized international money transfer companies can reduce costs and lock in exchange rates before completion.

What are Spanish property registration fees?

Property registration fees in Spain are approximately 1.5% of the property value. This covers registering the property deed at the Land Registry and is required for both new builds and resale properties.

Do I need a property lawyer in Spain?

Yes, hiring a Spanish property lawyer is essential and costs 1-2% of the property value. They handle legal due diligence, contract review, and ensure the purchase process complies with Spanish law.

Who pays the real estate agent fees in Spain?

The seller typically pays real estate agent fees in Spain, not the buyer. This is standard practice and means buyers don't need to budget for agent commissions in their purchase costs.

Can I get residency in Spain by buying property?

Property purchase alone doesn't guarantee Spanish residency. You need to meet specific conditions based on nationality, income, and activity. Consider the Golden Visa program for investment-based residency options.

What other costs should I budget for when buying in Spain?

Additional costs include notary fees, stamp duty, property surveys, insurance, and ongoing annual costs like property taxes (IBI), community fees, and utilities. Budget an extra 2-3% for miscellaneous expenses.