Discover the Spanish Costas and cities

Zoom in on the perfect location for you

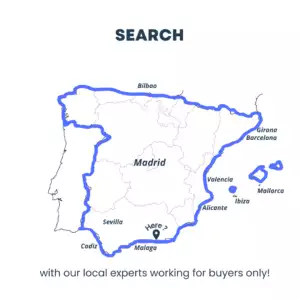

Spain offers a diverse range of properties to suit every lifestyle and preference. Whether you are looking for a vibrant city apartment, a tranquil countryside villa, or a beachfront property, you can find your ideal home in Spain. Explore the various regions to discover what makes each one unique and find the perfect spot for your next investment or relocation.

Some of you will want to compare weather statistics for different Spanish cities during winter months, don’t hesitate we did the work to help you.

Before discovering all the Spanish Costas, have a quick look at our customers’ reviews and if you have 30 seconds,

click to expand this title, and read our savvy words on how to find your dream property

A quick word on how to find your dream property

There are two (actually one smart) ways to find your ideal Spanish property:

- On your own with the help of a local Spanish real estate lawyer

- With the help of a property buyer (only working for you, not working for a seller) with the help of a local Spanish real estate lawyer

Yes sure, and some try it on their own, without a lawyer to save some pennies. Agreed.

Let’s tell us why we have built our network of local property hunters:

Of course, you can decide to search independently and think you will save money. As you don’t know the local markets, you won’t know if the properties’ prices are correct, you won’t know if the neighbourhood is safe,… you will miss a lot of issues. Last but not least, most of the time you live in a foreign country and can’t visit a property easily, so a first screening to optimise your visits is also beneficial.

So, at first, you might think that working with a property hunter in Spain would be costly. Still, many of our customers made a lot of money thanks to their services: by not buying a crap property, by not buying a property at the wrong location and as well thanks to the price negotiation of our partner with the seller.

The 7 reasons why a personal real estate shopper in Spain is a MUST for your property search:

#1 He knows the market

#2 He will save money for you

#3 He may have access to off-market properties

#4 He will save you time

#5 He will protect your interests

#6 He speaks Spanish and your language

#7 He will find solutions after your purchase

In this article, you will discover some of the missions that our local hunters have carried out in each Spanish Costas.

Read our detailed article on that and learn much more like how does a property finder work?

Costas & Islands

Here are the most well-known Spanish Costas, Spanish Islands and Cities, for each one, we will give:

- Quick overview of each region

- Indicative starting budget for villas and apartments, to give you a rough idea of how expensive the region is, it doesn’t mean more… You can find cheaper and more expensive properties.

- Highlighted places to visit

- Buyer profiles for the region

- Direct access to our local property hunters

- Image of a notable local place

- Map of the Costa with must-visit spots

- What we love in the region

- Latest deals from our local property hunters

- Direct access to newly built properties from our partners

(click any Costa to move directly to its dedicated section):

Top 4 Spanish Costas

Top Spanish Islands

Top Spanish Cities

Other Spanish Costas

If you don’t find your city in the list, just ask us directly we are constantly adding new partners and we will search in our network.

Costa Blanca

the #1 destination for foreigners buying real estate in Spain.

The Costa Blanca offers a prime investment opportunity with its stunning beaches, vibrant lifestyle, and charming coastal towns.

from €150,000 for an apartment

from €250,000 for a villa

Highlighted places

- Benidorm

- Elche

- Alicante

- Altea

- Calpe

- Torrevieja

- Vilajoyosa

Property Buyer Profiles

Families and retirees seeking beachfront villas for second homes or relocation, and young city lovers looking for vibrant nightlife.

![]()

![]() Top countries buying

Top countries buying

Dunes on Santa Pola beach, Costa Blanca

What we loved in Costa Blanca:

Sun-kissed Mediterranean coast, Pristine beaches and watersports, Charming coastal villages, Lively nightlife and entertainment, delicious cuisine, rich history, ideal for relaxation and adventure.

Real estate achievements on the Costa Blanca:

Read our detailed article on the Costa Blanca: Everything you ever wanted to know about the Costa Blanca.

Find all the major cities and useful places to visit on our detailed map of the Costa Blanca.

Monthly weather statistics for Alicante

Costa del Sol

the #2 destination for foreigners buying real estate in Spain.

The Costa del Sol: luxurious homes, sunny beaches, and Mediterranean charm.

from €200,000 for an apartment

from €300,000 for a villa

Highlighted places

- Málaga

- Torremolinos

- Fuengirola

- Nerja

- Marbella

- Estepona

- Casares

- Huelva

- Ayamonte

- Benalmádena

- Benahavís

- Cadiz

- Manilva

- Mijas

- Miramar

- Ojén

- Sotogrande

Property Buyer Profiles

Beach lovers, retirees, and investors looking for luxury villas and apartments, as well as young professionals seeking vibrant city life.

![]()

![]() Top countries buying

Top countries buying

Amazing panoramic view of Malaga City, Andalusia, Spain, Europe

What we loved in Costa del Sol:

Stunning beaches and coastal towns, Rich history and cultural attractions, Vibrant nightlife and dining options.

Notable property finds on the Costa del Sol:

Read our detailed article on the Costa del Sol: Everything you ever wanted to know about the Costa del Sol.

Find all the major cities and useful places to visit on our detailed map of the Costa del Sol.

Monthly weather statistics for Malaga

Costa Brava

the #3 destination for foreigners buying real estate in Spain.

from €200,000 for an apartment

from €300,000 for a villa

Highlighted places

- Begur

- Girona

- Llafranc

- Platja d’Aro

- Roses

- Tossa de Mar

Property Buyer Profiles

Couples seeking a second home or retirement villa, nature lovers, and beach enthusiasts looking for a relaxing countryside lifestyle.

![]()

![]() Top countries buying

Top countries buying

Mediterrenean beach in Palafrugell, Girona, Spain.

Mediterrenean beach in Palafrugell, Girona, Spain.

What we loved in Costa Brava:

Beautiful hidden coves and beaches, Rich cultural life and history, Delicious local food and gastronomy.

Client success stories on the Costa Brava:

Read our detailed article on the Costa Brava: Everything you ever wanted to know about the Costa Brava.

Find all the major cities and useful places to visit on our detailed map of the Costa Brava.

Monthly weather statistics for Girona

Costa Dorada

the #4 destination for foreigners buying real estate in Spain.

from €150,000 for an apartment

from €250,000 for a villa

Highlighted places

- Tarragona

- Calafell

- Cambrils

- Salou

- Comaruga

- Ametlla de Mar

- Reus

Property Buyer Profiles

Families looking for vacation apartments, investors interested in rental properties, and retirees seeking a tranquil Mediterranean lifestyle.![]()

![]() Top countries buying

Top countries buying

blue marina port in Salou Tarragona at Catalonia spain

What we loved in Costa Dorada:

Golden sandy beaches, Rich cultural heritage, Family-friendly resorts and activities.

Client property solutions on the Costa Dorada:

Read our detailed article on the Costa Dorada: Everything you ever wanted to know about the Costa Dorada.

Find all the major cities and useful places to visit on our detailed map of the Costa Dorada.

Spanish Islands

Balearic Islands

One of the most exclusive destination for foreigners buying real estate in Spain.

The Balearic Islands: crystal-clear waters, upscale villas, and a rich cultural heritage.

from €200,000 for an apartment

from €300,000 for a villa

Highlighted places

- Majorque

- Minorque

- Formentera

- Ibiza

Property Buyer Profiles

Luxury seekers, retirees, and young professionals looking for vibrant island life, as well as families seeking vacation homes.![]()

![]() Top countries buying

Top countries buying

Cala Salada and Saladeta in san Antonio Abad at Balearic Islands Spain. Typical house for fishing boats and rocks.

What we loved in the Balearic Islands:

Idyllic beaches and crystal-clear waters, Vibrant nightlife and cultural events, Charming villages and local cuisine.

Real estate victories in the Balearic Islands:

Read our detailed article on the Balearic Islands: Everything you ever wanted to know about the Balearic Islands.

Find all the major cities and useful places to visit on our detailed map of the Balearic Islands.

Monthly weather statistics for Mallorca

Canary Islands

#1 destination for remote workers and pensioners seeking a warm winter escape

Volcanic landscapes, year-round sunshine and real estate at competitive prices.

from €150,000 for an apartment

from €250,000 for a villa

Highlighted places

- Lanzarote

- Fuerteventura

- Tenerife

- Gran Canaria

- La Palma

- La Gomera

- El Hierro

- San Cristóbal de la Laguna

- Santa Cruz de Tenerife

- Telde

Property Buyer Profiles

Adventure seekers, retirees, and families looking for vacation homes, as well as investors interested in rental properties.![]()

![]() Top countries buying

Top countries buying

View on the beach Sotavento with golden sand and crystal sea water of amazing colors on Costa Calma on the Canary Island Fuerteventura, Spain. Beach Playa de Sotavento, Canary Island, Fuerteventura.

What we loved in the Canary Islands:

Stunning volcanic landscapes and beaches, Vibrant nightlife and cultural events, Rich cultural heritage and local cuisine and last but not least, 20 degrees all year long :-).

Client success stories on the Canary Islands:

Read our detailed article on the Canary Islands: Everything you ever wanted to know about the Canary Islands.

Find all the major cities and useful places to visit on our detailed map of the Canary Islands.

Monthly weather statistics for Tenerife

Spanish Biggest cities

Sure, Madrid is the Capital of Spain but you’ll find Barcelona and Valencia in the top 3.

In recent years, other Spanish cities such as Malaga, Alicante, and Sevilla have experienced a significant increase in demand for real estate purchases by foreign buyers.

If you don’t find your city in the list, just ask us directly we are constantly adding new partners and we will search in our network.

Madrid

#1 destination for international Real estate buyers seeking cosmopolitan living, a strong cultural scene, and excellent business opportunities.

Madrid and its grand boulevards, high-end properties, and an unmatched cultural scene.

from €250,000 for an apartment

from €500,000 for a villa

Highlighted places

- Gran Vía

- Retiro Park

- Prado Museum

- Royal Palace

- Plaza Mayor

Property Buyer Profiles

Young professionals and families looking for vibrant city life, investors seeking high rental yield apartments, and expats relocating for work.![]()

![]() Top countries buying

Top countries buying

Gran Via, the main shopping street in Madrid, Spain at dusk

What we loved in Madrid:

Rich cultural life and museums, Excellent public transport connections, Vibrant nightlife and dining options.

Key property purchases in Madrid:

An architect house in the region of Madrid

Our best ideas for planning your holidays in Spain

Planning a city trip to Madrid? Start with our two infographics with good ideas.

Weather statistics for every month in Madrid

Barcelona

#1 destination for international Real estate buyers looking for a blend of historic charm, modern living and coastal beauty.

Barcelona historic Gothic Quarter, elegant homes, and world-renowned cuisine

from €250,000 for an apartment

from €500,000 for a villa

Highlighted places

- Sagrada Família

- Park Güell

- La Rambla

- Gothic Quarter

- Casa Batlló

Property Buyer Profiles

Young city lovers, remote workers seeking vibrant urban life, investors in high-demand rental properties, and families relocating for quality of life.![]()

![]() Top countries buying

Top countries buying

Barcelona, promenade of Barceloneta beach with people enjoying sunny day in Barcelona and W hotel on background, Catalonia, Spain

What we loved in Barcelona:

Iconic architecture and cultural sites, Beaches and coastal activities, Multicultural atmosphere.

Client success stories in Barcelona:

Our best ideas for planning your holidays in Spain

Planning a city trip to Barcelona? Start with our two infographics with good ideas.

Monthly weather statistics for Barcelona

Valencia

Real estate buyers desiring a blend of historic living, coastal access, a lively cultural atmosphere, and more affordable prices than Barcelona.

Valencia is the hart of beautiful beaches, historic old town, and a thriving culinary scene.

from €150,000 for an apartment

from €300,000 for a villa

Highlighted places

- City of Arts and Sciences

- Valencia Cathedral

- Central Market

- La Lonja

- Turia Gardens

Property Buyer Profiles

Beach lovers and families looking for second homes, retirees seeking tranquil lifestyles, and investors interested in high-yield properties.![]()

![]() Top countries buying

Top countries buying

What we loved in Valencia:

Beautiful beaches and coastal activities, Rich historical and cultural sites, Delicious local cuisine.

Successful home buys in Valencia:

Read our detailed article on Valencia: Everything you ever wanted to know about Valencia.

Find all the major cities and useful places to visit on our detailed map of Valencia.

Monthly weather statistics for Valencia

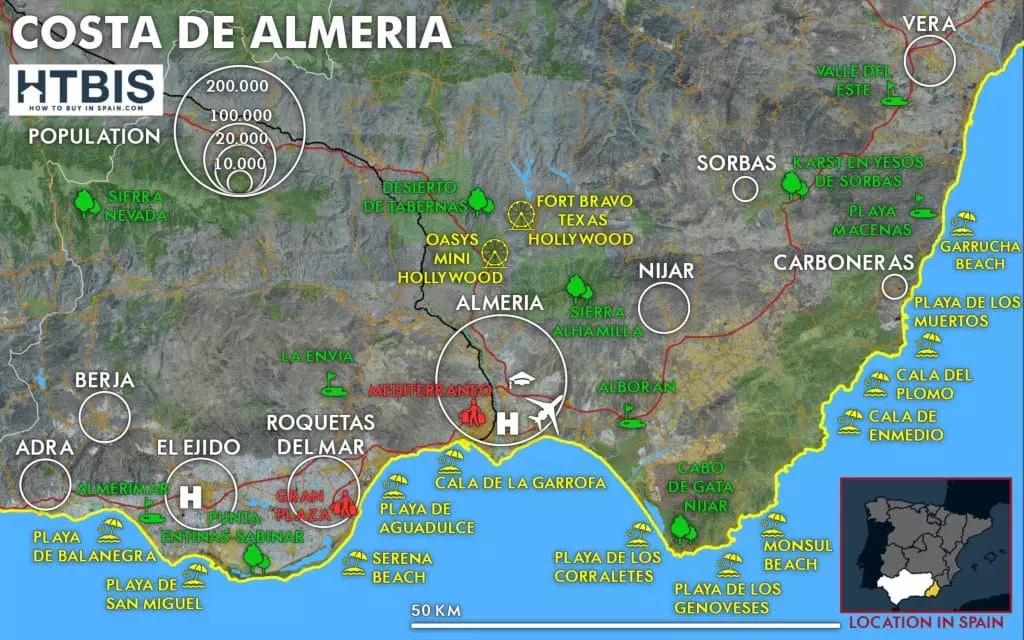

Costa de Almería

Appeals to budget-conscious buyers seeking a tranquil Mediterranean lifestyle.

The Costa de Almería: unspoiled beaches, affordable luxury properties, and a laid-back atmosphere.

from €120,000 for an apartment

from €220,000 for a villa

Highlighted places

- Almería

- Roquetas de Mar

- Mojácar

- Vera

- Garrucha

- Carboneras

- Agua Amarga

Property Buyer Profiles

Nature enthusiasts, retirees, and families looking for tranquil coastal living, as well as investors in beachfront properties.

![]()

![]() Top countries buying

Top countries buying

Morning on the Salinas beach in Cabo de Gata, Almeria, Spain

What we loved in Costa de Almería:

Unspoiled beaches and natural parks, Charming coastal towns, Rich history and cultural sites.

Remarkable home discoveries on the Costa de Almería:

Read our detailed article on the Costa de Almería: Everything you ever wanted to know about the Costa de Almería.

Find all the major cities and useful places to visit on our detailed map of the Costa de Almería.

Monthly weather statistics for Alicante

Costa del Azahar

Appeals to buyers looking for charming coastal properties and cultural richness.

Costa del Azahar offers a prime investment opportunity with its pristine beaches, charming villages, and rich cultural heritage.

from €130,000 for an apartment

from €240,000 for a villa

Highlighted places

- Castellón

- Península de Peñíscola

- Benicàssim

- Oropesa del Mar

- Alcossebre

- Vinaròs

Property Buyer Profiles

Families and retirees seeking tranquil coastal living, as well as investors in high-yield rental properties.

![]()

![]() Top countries buying

Top countries buying

Peniscola beach in Castellon Valencian community of spain

What we loved in Costa del Azahar:

Pristine beaches and watersports, Charming coastal villages, Rich cultural heritage.

Property search triumphs on the Costa del Azahar:

Read our detailed article on the Costa del Azahar: Everything you ever wanted to know about the Costa del Azahar.

Find all the major cities and useful places to visit on our detailed map of the Costa del Azahar.

Monthly weather statistics for the top 20 Spanish Cities

Costa de Barcelona

Vibrant city life, high-end real estate, and stunning coastal views.

Costa de Barcelona offers a perfect mix of city and beach life with vibrant culture and beautiful coastal towns.

from €200,000 for an apartment

from €300,000 for a villa

Highlighted places

- Badalona

- Sitges

- Mataró

- Vilanova i la Geltrú

- Castelldefels

Property Buyer Profiles

Young professionals, investors in rental properties, and families seeking a combination of city and beach life.

![]()

![]() Top countries buying

Top countries buying

Tourists Sunbathing on beach lining Costa Brava coastline in Cadaques, Spain.

What we loved in Costa de Barcelona:

Vibrant cultural life and events, Beautiful beaches and coastal towns, Rich history and architecture.

Real estate milestones on the Costa de Barcelona:

Read our detailed article on the Costa de Barcelona: Everything you ever wanted to know about the Costa de Barcelona.

Find all the major cities and useful places to visit on our detailed map of the Costa de Barcelona.

Monthly weather statistics for Barcelona

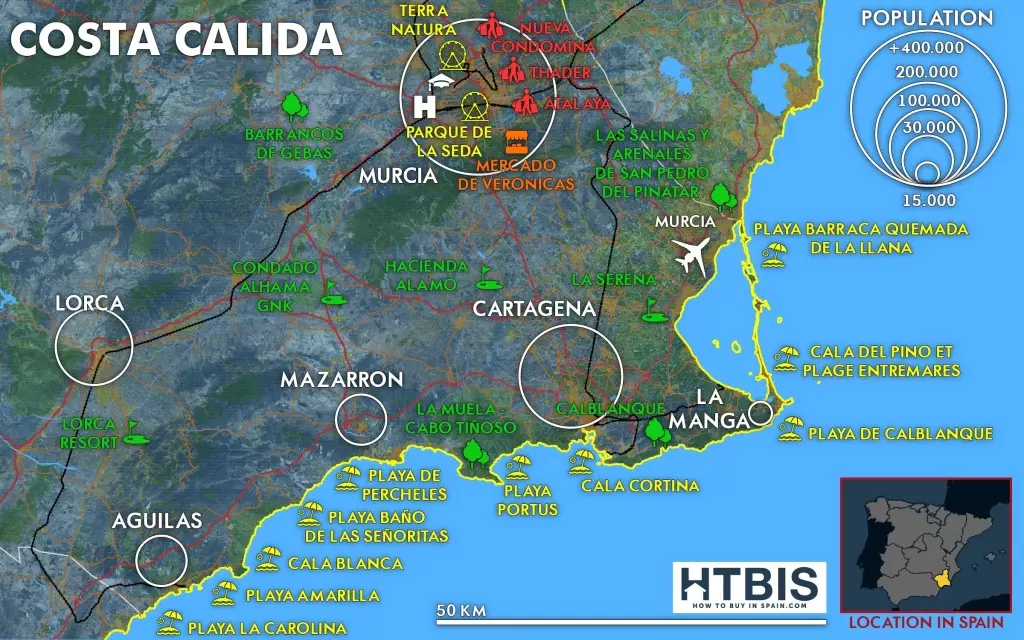

Costa Cálida

The Costa Cálida: warm waters, affordable luxury homes, and health-promoting climate.

Costa Cálida, with its mild climate appeals to retirees and health-conscious buyers seeking value and comfort

from €120,000 for an apartment

from €220,000 for a villa

Highlighted places

- Murcia

- Cartagena

- La Manga

- Águilas

- Los Alcázares

Property Buyer Profiles

Retirees, families, and investors in vacation rentals.

![]()

![]() Top countries buying

Top countries buying

Mazarron, Murcia, Spain: Beautiful beach view from the promenade on a sunny and clear day in Mazarron, Murcia, Spain. People relaxing and sunbathing on the beach.

Know everything on the Costa Calida: its Airports, its AVE stations, its Cities and villages, its shopping places: Traditional & Flea markets, Outlets and shopping malls. What should you visit? The Unesco sites, the parks for kids, the green parks, the golf courses, the universities and last but not least the top beaches. Check our infographic.

What we loved in Costa Cálida:

Mild year-round climate, Beautiful beaches and watersports, Vibrant local culture.

Property hunting deals on the Costa Cálida:

Read our detailed article on the Costa Cálida: Everything you ever wanted to know about the Costa Cálida.

Find all the major cities and useful places to visit on our detailed map of the Costa Cálida.

Monthly weather statistics for the Costa Calida

Costa de la Luz

The Costa de la Luz: golden sands, elegant properties, and rich Andalusian heritage.

Costa de la Luz boasts stunning beaches and a laid-back atmosphere perfect for relaxation.

from €100,000 for an apartment

from €200,000 for a villa

Highlighted places

- Cádiz

- Sevilla (not really on the Costa de la Luz but very close)

- Huelva

- Tarifa

- Chipiona

- Isla Cristina

Property Buyer Profiles

Families, retirees, and nature lovers.

![]()

![]() Top countries buying

Top countries buying

Panorama from Bay of Cadiz in Cadiz Spain

What we loved in Costa de la Luz:

Golden beaches and watersports, Charming coastal towns, Vibrant nightlife and cultural events.

Real estate deals on the Costa de la Luz:

Read our detailed article on the Costa de la Luz: Everything you ever wanted to know about the Costa de la Luz.

Find all the major cities and useful places to visit on our detailed map of the Costa de la Luz.

Monthly weather statistics for Cadiz

Costa Tropical

Costa Tropical offers pristine beaches with a tropical climate year-round.

from €130,000 for an apartment

from €230,000 for a villa

Highlighted places

- Almuñécar

- Salobreña

- Motril

- La Herradura

- Castell de Ferro

Property Buyer Profiles

Nature lovers, retirees, and families seeking a tranquil lifestyle.

![]()

![]() Top countries buying

Top countries buying

What we loved in Costa Tropical:

Tropical climate and lush landscapes, Pristine beaches and watersports, Charming coastal villages.

Real estate deals on the Costa Tropical:

Read our detailed article on the Costa Tropical: Everything you ever wanted to know about the Costa Tropical.

Find all the major cities and useful places to visit on our detailed map of the Costa Tropical.

Monthly weather statistics for the top 20 major cities in Spain

Costa de Valencia

Appeals to buyers looking for a lively cultural scene and high-quality coastal living with a lower budget than for the Costa de Barcelona

Costa de Valencia is known for its sun-kissed beaches, vibrant culture, and lively nightlife.

from €140,000 for an apartment

from €240,000 for a villa

Highlighted places

- Gandia

- Oliva

- Denia

- Sagunto

- Cullera

Property Buyer Profiles

Families, retirees, and beach lovers.

![]()

![]() Top countries buying

Top countries buying

Denia Las Marinas beach towards its northern part

What we loved in Costa de Valencia:

Sun-kissed beaches and watersports, Rich cultural heritage and events, Delicious local cuisine.

Real estate deals on the Costa de Valencia:

Read our detailed article on the Costa de Valencia: Everything you ever wanted to know about the Costa de Valencia.

Find all the major cities and useful places to visit on our detailed map of the Costa de Valencia.

Monthly weather statistics for Valencia