Reading time 2 minutes. Use our table of content for a quick read.

Reading time 2 minutes. Use our table of content for a quick read.

Last Updated on 20/05/2025 by STEPHANE

Click on any flag to get an automatic translation from Google translate. Some news could have an original translation here: News Nouvelles Nieuws Noticias Nachrichten

How do I choose between fixed and variable rates for a mortgage?

-

Should I take a mortgage with fixed or variable rates?

Fixed-rate mortgages and variable-rate mortgages are the two main categories of mortgages you can pick. Of course, there are many other possibilities between the two.

-

Why would you take a fixed-rate mortgage?

A Fixed rate mortgage has the advantage that whatever the market conditions will do in the future, it will remain the same. To get that advantage, you will on average pay a higher rate than on a variable-rate mortgage, for instance, as of May 2025, mortgages with variable rates are issued at rates of 2.9% while those with fixed rates are issued with 3.0% for an average length of 24 years.As we are writing, May 2025, Inflation rate has stabilized in Spain: the level as of May 2025 is 2.5%.

-

Why would you take a mortgage with a variable rate?

It could be because it is less expensive and because you don’t see inflation or rates going higher or because you are comfortable financially and can face higher rates. Another reason for variable rates to be lower is that for the banks issuing them, it matches their sources of funds (saving’s accounts).

So, to sum up, if you want safety, take a fixed-rate mortgage. If you see inflation spiking or interest rates going higher (in general due to a strong economy) you could as well go for a fixed-rate mortgages. Of course, the longer your mortgage is the higher your risk will be.

Don’t hesitate to ask to your Spanish mortgage broker a pricing with both and compare both offers.

-

May 2025 update

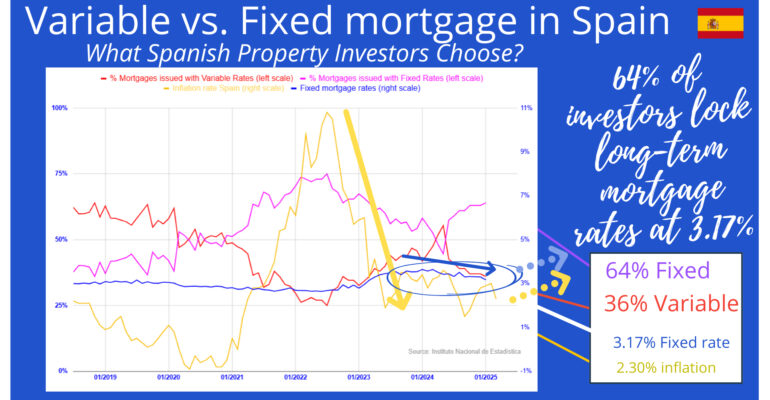

After the dramatic changes seen in recent years, the mortgage market has stabilized significantly. While in 2021-2022 we saw a sharp increase in fixed-rate mortgages due to inflation concerns, the trend has now moderated as of May 2025. Currently, 64% of mortgages are issued with fixed rates, a slight decrease from the 75% peak we saw in late 2021. This reflects increased confidence in economic stability and normalized inflation expectations.Check the evolution of the percentage of mortgages with fixed and with variable rates

-

Are fixed mortgage rates less expensive than variable mortgage rates?

As of May 2025, the gap between fixed and variable mortgage rates has narrowed significantly. Fixed rates are currently averaging 3.0%, while variable rates average 2.9%, making the difference minimal at just under 0.4 percentage points. This is a dramatic change from the 0.5-0.7 percentage point gap we saw during the high inflation period of 2021-2022.Check the evolution of the mortgage rates (average, fixed and variable )over the last year

-

Our other resources on “Spanish mortgage rates”

Stéphane, Senior analyst and strategist at HTBIS

Stéphane, with over 20 years of experience in real estate, finance, and entrepreneurship, is the co-founder of www.howtobuyinspain.com. With an extensive network of local partners in Spain, his deep commitment to the real estate sector, strong analytical skills, and a problem-solving mentality have fueled his success. Constantly eager to learn and passionate about teaching, Stéphane believes in the power of knowledge-sharing to master any subject.