Reading time 4 minutes. Use our table of content for a quick read.

Reading time 4 minutes. Use our table of content for a quick read.

Last Updated on 07/03/2023 by STEPHANE

Click on any flag to get an automatic translation from Google translate. Some news could have an original translation here: News Nouvelles Nieuws Noticias Nachrichten

27.055 bank repossessed properties in Spain in 2019

This is a very good news for the real estate sector in general and for the property owners in Spain in particular.

Will this situation change in 2020 due to the Coronavirus and its impacts on the Spanish real estate?

The annual rate of housing foreclosures in Spain is 0.05%

The total number of registrations for foreclosure on dwellings initiated in 2019 was 7.129 houses -21% vs 2018. We talk about properties owned by private person only. If we talk about housings in general, the number is 27.055 foreclosed properties during 2019.

This is what the Instituto Nacional de Estadistica just published in its report.

3% increase vs 2018

For 2019, 0.1% of all the properties existing in Spain. According to the census, there are 25m properties in Spain, follow the link and check our table on that.

Look at the evolution of foreclosure over the last 4 years.

It is an impressive 4 year in a row decrease since 2014: -5% in 2018, -33% in 2017, -31% in 2016and -15% in 2015.

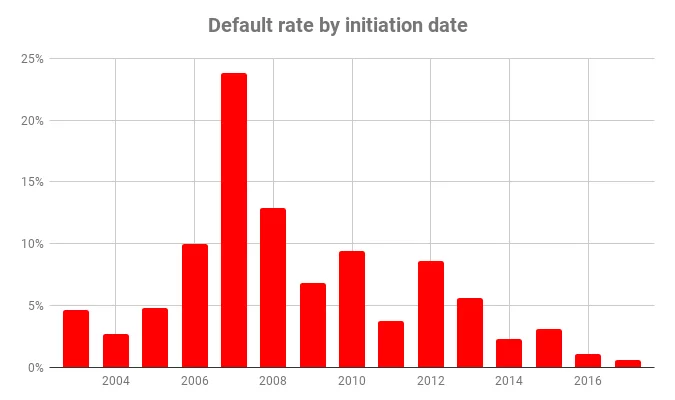

Mortgage default rates according to their initiation dates

As you can see on this chart, 24% of mortgages that defaulted in 2019 were initiated in 2007. 50% of the defaults in 2019 were mortgages initiated between 2005 and 2008. Why? The prices where much higher before 2008 and leverage was bigger just before the crisis.

As you can see on our chart, prices were much higher at that time: €2.100 vs €1.653 now (December 2019).

Which years have the most defaults vs the number of issued mortgages?

Most impacted regions during 2019

Regions with the highest foreclosure rates for housing are:

- Catalonia, 5757 properties bank repossessed properties

- Andalusia, 5681 housing were foreclosed in 2019

- The Valencian community, 5356 properties foreclosed

Foreigners active in the same regions

It could represent a nice opportunity for foreigners as they are active in all those regions. As a reminder, foreigners bought 16% of all transactions during the last year.

Click on the image and get our last report analyzing where foreigners are buying real estate in Spain in.

Why is the number of bank repossessed properties decreasing?

The three main reasons are:

- The economy in Spain is stronger: GDP growth above 2% and one of the highest in Spain, see the sixth “must see chart on the Spanish real estate” comparing the Spanish growth rate with all its EU counterparts. Going in Sync with higher growth, you have a decrease in the unemployment rate as you can see in our table with the economic statistics of Spain. You can read our paper on that: Spanish GDP growth to remain strong up to 2021

- Financing rates are very low: check our table on mortgage and financing rates in Spain or read our article on the best financing conditions in Spain.

- A final reason was explained above: about 50% of the foreclosures are mortgages that were initiated in 2006, 2007 or 2008. Right now, we are 10 years later and so people could adjust in the meantime on one side and on the other side, as prices are much lower, people are taking a much more “calculated” risk.

We expect the number of bank repossessed properties to rise in 2020 due to the Coronavirus and due to the economic situation deteriorating.

We shouldn’t have the same situation as we had in 2008 for many reasons:

- The situation is much more stable: less leverage with banks, less leverage with promoters, lower prices and correct if you compare with international cities

- We should pay attention to the economic situation for the next 2 years and of course keep a close eye on the Coronavirus situation and its impacts on travel.

- Another positive: the low financing rates that should continue to help buyers.

Do you want to find bank repossessions in Spain right now?

Do you want to have a look at properties repossessed by Spanish banks? Have a look at our article, one of the most read of our site, on that subject: Spanish bank repossessions: Your ultimate guide to 120.000 properties.

If you are looking at buying a property on the Costa Blanca, this is our most recent paper: The last bargain on the Costa Blanca? 12.000€ for a Spanish Bank repossession

Are you looking for a competitive rate for your mortgage in Spain?

Here was the update of the last quarter of 2018

The annual rate of housing foreclosures in Spain is 0.05%

The total number of registrations for foreclosure on dwellings initiated in the third quarter of 2018 was 1.551 houses vs 2.181 in the same quarter of 2017 and 4.696 in 2016. We talk about properties owned by private person only. If we had to talk about housings in general, the number is 7.182 foreclosed properties during the quarter.

29% decrease vs 2017

For 2017, 27.171 properties were foreclosed, (housing and others) i.e. 0.1% of all the properties existing in Spain. According to the census, there are 25m properties in Spain, follow the link and check our table on that.

Default rate by initiation date

The default rate is the highest and represents about 50% of all defaults for the mortgages initiated between 2005 and 2008… when the prices where at the top… and just before the crisis.

Regions with the highest foreclosure rates for housing are:

- La Rioja, 0.26% of all existing properties, 121 housing during the quarter

- The Valencian community, 0.16% of all existing properties, 1.696 housing during the quarter

- Castilla y Leon, 0.14% of all existing properties, 228 housing during the quarter

Here was the update of the last quarter of 2017

- The annual rate of foreclosure in Spain is 0.1%

The total number of registrations for foreclosure on dwellings initiated in the fourth quarter of 2017 was 2.103 houses vs 4.696 in the same quarter of 2016.

That is what the Instituto Nacional de Estadistica said in its last report.

- 34.2% decrease for 2017

For 2017, 27.171 properties were foreclosed, i.e. 0.1% of all the properties existing in Spain. According to the census, there are 25m properties in Spain, follow the link and check our table on that.

This is a nice decrease of 34.2% vs the numbers of 2016.

Look at the evolution of foreclosure over the last 4 years.

It is an impressive 3 year in a row decrease since 2014: -34% in 2017, -31% in 2016, -15% in 2015.

- Default rate by initiation date

The default rate is the highest and represents about 50% of all defaults for the properties acquired in 2006, 2007 and 2008.

Regions with the highest foreclosure rates for housing are:

- The region of Murcia 0.43%, 3.252 units

- Andalusia 0.42%, 13.644 units

- Valencian community 0.42%, 10.212 units

Who is buying those bank properties in Spain?

We found at least one institutional buying bank properties in Spain for more than 10 years… Here is our article on that: “Are bank properties in Spain a nice investment opportunity?”

Check the full press release in Spanish.

Looking for an expert in Spain? Ask us directly!