Reading time 19 minutes. Use our table of content for a quick read.

Reading time 19 minutes. Use our table of content for a quick read.

Last Updated on 08/07/2025 by STEPHANE

Click on any flag to get an automatic translation from Google Translate. Some news could have an original translation here: News Nouvelles Nieuws Noticias Nachrichten

What are the best Spanish mortgage rates?

Spanish Mortgage Rates 2025: Your complete Guide to Financing Your Spanish Property

Quick Summary: Spanish Mortgage Rates July 2025

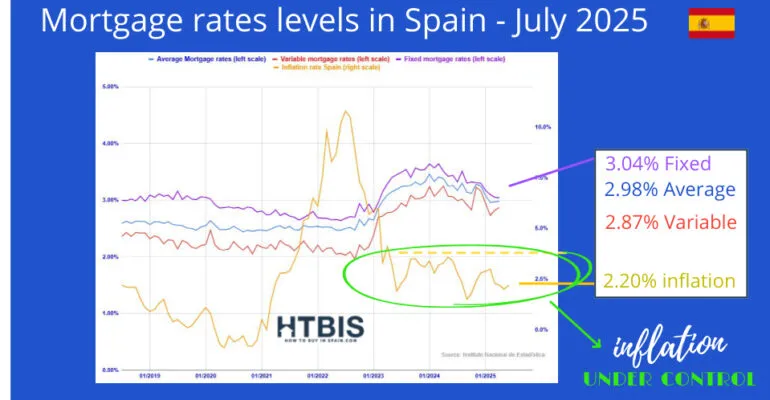

- Average Rate: 2.98% (near historic lows)

- Fixed Rate: 3.04% (67% of mortgages)

- Variable Rate: 2.87% (33% of mortgages)

- Non-Resident Deposit: 30% minimum (70% max financing)…and don’t forget about 15% taxes and costs

- Resident Deposit: 20% minimum (80% max financing) …and don’t forget about 15% taxes and costs

- Processing Time: 4-8 weeks approval

Quick Navigation:

Here is our July 2025 update with the latest data available

Leveraging our expansive network of local partners, we secure Spain’s most favourable mortgage rates for those looking to finance their homes. Throughout much of 2022, we observed significant discounts on mortgage rates as inflation surged while long-term rates remained subdued, thanks to the European Central Bank’s (ECB) efforts. In early 2025, inflation is more controlled, at 1.9% as of May 2025, returning to the low end of the range over the past three years. It appears that economies are suffering from the ECB’s restrictive monetary policy. In this context, some market experts anticipate that the central bank will lower rates. We can already see this impacting mortgage conditions and long-term rates.

To stay informed about the latest Spanish mortgage rate trends, it’s crucial to consult real-time data from the most recent mortgages issued in Spain. This insight allows you to understand the most competitive rates currently available. Foreigners should note that rates may vary as their assets are primarily located overseas.

We’ve built the most extensive database to monitor fluctuations in this sector, allowing us to generate dynamic and engaging charts. The “Instituto Nacional de Estadísticas” (INE) has recently published mortgage statistics for Spain as of April 2025, providing a clear view of current market rates.

Thanks to our network of local partners, we offer the best mortgage rates in Spain for those looking to finance a home in Spain. Take 30 seconds to complete this quick form to get the best Spanish mortgage rates.

-

Spanish mortgage rates: our 2-minute video

Would you like to watch this video in your language? Click on the bottom right of the video on “cc” to get subtitles in your language.

-

What are the current mortgage rates in Spain?

Current market conditions

- The average mortgage has an interest rate of 2.98% (vs 3.25% at the end of December 2024)

- The lowest rate ever was 2.44%, reached in September 2020.

- The average rate for variable-rate mortgages is 2.87% (vs 3.16% end of December 2024)

- The average rate for fixed-rate mortgages is 3.04% (vs 3.30% end of December 2024)

Check the evolution of the mortgage rates (average, fixed, and variable ) over the last years on our interactive chart (browse with the mouse to check data)

What are the best mortgage rates for our customers?

As of September 2024, our partner can get perfect conditions for mortgages for our non-resident buyers:

- Fixed rates: from 2.85%

- Mixed solution: from 2.50% fixed for 5 years, after Euribor + 0.75%

- Variable rates: from 2.50% fixed for 1 year, after Euribor + 0.75%

And, of course, they don’t stop with foreigners; our partner gets very competitive mortgage rates for Spaniards:

- Fixed rates: from 2.52% (if taking other products like insurance from the bank, for instance,…)

- Mixed solution: from 1.50% fixed for 5 years, after Euribor + 0.60%

- Variable rates: from 1.35% fixed for 1 year, after Euribor + 0.25%

So, don’t hesitate to fill out this quick form if you want a free quote from our partner. They specialise in assisting foreigners seeking a mortgage in Spain. Please note that to obtain the best rates, banks often add certain conditions, as in your home country.

Essential information on Spanish Mortgages for non-residents

As a non-resident, you can take a mortgage to finance your second home or your investment. Of course, since your assets won’t be based in Spain, the bank will require warranties and typically won’t allow a loan-to-value ratio exceeding 70%. The loan-to-value is the amount of mortgage you can get divided by the value of your property before tax, but this percentage is only for reasonable inquiry. Don’t hesitate to ask for a free quote from our mortgage broker; he knows exactly how it works and which Spanish banks are friendly to foreigners.

Don’t miss our new detailed article on that subject: Mortgage rates in Spain for non-residents: our detailed guide.

-

Calculate the cost of your Spanish mortgage.

Check our ultimate Spanish mortgage calculator.

To help you out, we’ve created an easy-to-use table showing the monthly repayments for various mortgage amounts. If you want to delve deeper into the details, use our calculator to fine-tune your mortgage to your specific situation, and you will find out what your monthly payments, mortgage schedule, and other information would be.

We developed a detailed mortgage calculator, including payment schedules and monthly payments.

What is the cost of a €100,000 mortgage over 10 years?

If you want to go into the details, here is a calculation example we did:

As you will see, if you take out a €100,000 mortgage for 10 years at a rate of 3.5%, your monthly payment to repay the mortgage will be €989.

Thanks to our Spanish mortgage rate calculator, you can change any number and calculate what your situation would be.

Summary table of your monthly reimbursements for a €100.000 Mortgage

-

Buy to let in Spain?

If you are about to invest in Spain, it is always interesting to compare the financing conditions with your return prospects. Check our last article on that subject:

What return will you make on your Spanish Property investment? If you view your property investment in Spain as a financial investment, adding some financing (without being excessive) will increase your return and decrease your costs.

-

Should I take a mortgage with fixed or variable rates?

Fixed-rate and variable-rate mortgages are the two main categories of mortgages you can choose from. Of course, there are many other possibilities between the two.

Examine the evolution of the percentage of mortgages with fixed and variable rates in relation to the inflation rate.

The Spanish mortgage market has undergone a dramatic transformation since 2021. Our latest data show that 67% of property investors now choose fixed-rate mortgages at 3.04%, while just 33% opt for variable rates—a complete reversal from the pre-2021 landscape when variable rates dominated at 60-65%.

This shift tells a compelling story: When inflation exploded from near-zero to 11% in 2022, investors rushed to lock in fixed rates, pushing fixed-rate adoption to 75% at its peak. Now, even as inflation has cooled to 2.20%, the majority remains cautious, maintaining their preference for fixed-rate protection.

The key takeaway: Spanish property investors have learned from the recent inflation shock. Despite rates declining from their peaks, 67% still choose the certainty of fixed rates over potential savings from variable options. This persistent preference for stability suggests that the market anticipates future inflation risks—a view we share, as we believe current inflation levels represent the lower end of the range.

Why would you take a fixed-rate mortgage?

A fixed-rate mortgage has the advantage that, regardless of future market conditions, the interest rate will remain the same. To get that advantage, you will, on average, pay a higher rate than with a variable-rate mortgage. For instance, as of September 2024, mortgages with variable rates were issued at an average rate of 2.92%, while those with fixed rates were issued at 3.30% for an average term of 24 years.

Why would you take a mortgage with a variable rate?

It could be because it is less expensive than a mortgage with fixed rates (monthly instalments), as you don’t have to worry about inflation or rates increasing, or because you are financially comfortable and can handle higher rates in the future. Another reason variable rates cost less than fixed rates is that for the banks issuing them, it matches their sources of funds, such as savings accounts, and they take less risk by issuing them rather than fixed-rate mortgages.

To sum up, if you want safety, take a fixed-rate mortgage. If you see inflation spiking or interest rates rising (in general due to a strong economy), you could consider a fixed-rate mortgage. Of course, the longer your mortgage is, the higher your risk will be.

Don’t hesitate to ask your Spanish mortgage broker for pricing with both and compare both offers.Inflation update since the start of 2023

Following the significant global inflation spike in 2022, inflation in Spain has finally moderated to 2.2% as of August 2024. We note that since 2022, the trend has shifted significantly, with the majority of mortgages now issued at fixed rates. We kept telling you in 2022 to lock in those crazy long-term rate levels… remember our chart:

As we enter 2025, with inflation now at what we view as the lower end of its range, we see a higher risk of inflation rising from here. Some people see a real risk of inflation staying high, which in turn should lead to higher variable rates. Since June 2023, we have continued to see fixed-rate mortgage initiations dominate, and we believe this trend will likely persist. While rates have declined through late 2024 and early 2025, we strongly recommend locking in fixed rates now while they remain historically attractive. As of early 2025, with both short-term and long-term rates converging around 2.3-2.4%, this presents an excellent opportunity to secure predictable financing costs before potential inflation pressures push rates higher again. Check our interactive chart on that.

We wrote an article on that subject: “Fixed or Variable Mortgage for My Spanish Home?“

-

How do you secure the best mortgage rates in Spain?

You are about to buy a lovely second home in Spain. Do you want to know how to get the best mortgage rates on your Spanish property? Even as a foreigner?

Check our detailed paper on this subject and follow the link or listen to our 2-minute video on how to apply for your mortgage up to the end and get all our tips to get the best rates:You have to ask yourself: What is the ideal mortgage customer for a bank? The bank will take a risk, the risk of not being repaid. In this case, the bank will need to take legal action to control your property and sell it on the market afterwards. We saw what happened after the 2008 financial crisis: thousands of properties were handed over to banks as owners couldn’t pay their mortgages.

The ideal mortgage customer for a Spanish bank

- has a good professional profile: he is employed and has a stable, nice income stream,

- has a good credit report, he does not have too much debt vs. his income,

- can afford to have debts: his debt-to-income ratio is under 35%, which means that his monthly net income is three times bigger than his monthly debt repayments.

- The property has a good resale value:

- The property price is correct vs. the market

- There is demand in the market for such a property

- is coming from OECD countries. As you are aware, the implementation of anti-money laundering laws across Europe has made it challenging for banks to lend to residents of certain countries. Of course, if you are a resident of the European Union, it will be the easiest.

How to get the best rates as a non-resident?

Get a free mortgage quote.

At howtobuyinSpain.com, you’re in good hands. We work with a mortgage broker who gets the best mortgage prices from all Spanish banks. Depending on your profile, some banks will be more aggressive, while others won’t. Our mortgage partner knows that, and they will go to the best bank or ask for quotes from many Spanish banks to get you the best quote. They work with all the biggest Spanish banks, including BBVA, Bankia, and Santander. Get a free mortgage quote from our partner.

-

Spanish Mortgage Rates: Market Insights and Trends

423,761 mortgages issued in Spain in 2024

2022 was a record year for mortgage rates in Spain, with 464,000 credits issued. Even stronger than 2021, which was already a strong year. So, in 2024, with the rise of interest rates, the number of mortgages is back to a strong level and growing 11% vs the previous year (which was itself a weak year with a decrease of 18%), while at the same time, the number of transactions increased by 7% to 636,909.

A healthy market: Only 67% of properties are bought with a mortgage (vs 64% in 2023). In our opinion, the market is not over-leveraged. Have a quick look at the table for statistics since 2015. Yes, we are far from the high-leverage situation we had in 2007.

Last but not least, it is always interesting to know the long-term rates and the Euribor, as those are the rates at which Spanish banks get financed.

Spanish Bank Financing Costs: 10-Year Bond Yields vs. Euribor Rates (2020-2025)

The chart reveals a fascinating story of European monetary policy and interest rate evolution:

The Ultra-Low Rate Era (2020-2022)

From 2020 through early 2022, all rates remained historically low. The 10-year Spanish bond yield hovered between 0% and 0.5%, while both 1-month and 12-month Euribor rates were actually negative – a remarkable period where banks essentially paid to borrow money.

The Great Rate Surge (2022-2024)

Starting in early 2022, we witnessed a dramatic shift. All three rates exploded upward in response to the ECB’s aggressive monetary tightening to combat inflation:

- 10-year bonds peaked around 3.7% in late 2023

- 12-month Euribor reached above 4%

- 1-month Euribor climbed to nearly 4%

The Turning Point (Late 2024-2025)

The most encouraging development for investors is the clear reversal beginning in late 2024. As of early 2025, all rates have begun declining:

- 1-month Euribor: 1.9% (down from ~4%)

- 12-month Euribor: 2.1% (down from >4%)

- 10-year bond: 3.2% (down from ~3.7%)

Implications for Property Investors – Our View

While the current rate decline is encouraging, we believe investors are seeing a critical inflection point. With inflation now at what we view as the lower end of its range, we see asymmetric risks tilted toward higher inflation from here. In this environment, we strongly recommend property investors lock in long-term fixed rates now. The convergence of short and long-term rates around 2.3-2.4% presents an excellent opportunity to secure predictable financing costs before potential inflation pressures push rates higher again.

The strong 11% year-over-year growth in Spanish mortgage issuance suggests the market agrees – now is the time to act on financing while rates remain historically attractive.

Historical evolution of Spanish mortgage rates and other & useful information

- The average mortgage duration is 25 years

- Only 9% of issued mortgages in Spain are more significant than 80% of the property value.

- 33% have variable interest rates (vs 37% in December 2024)

- 67% have fixed interest rates (vs 63% in December 2024)

- The average amount issued per mortgage is €155,900.

Check the evolution of the average amount issued per mortgage over the last year in Spain in our interactive chart

- How much leverage is given by banks? What is the average Loan-to-Value in Spain? (If your property value is 100%, how big will your mortgage be?) The quick answer is 64%.

- 39,176 mortgages were issued +14.4% vs last year.

- € 6.1 billion of mortgages issued for housing in April 2025, +28.5% compared to 2024.

-

Resources on Spanish mortgage rates

Discover the best new build projects in Spain.

Check out our latest articles on Spanish mortgage rates

- Spanish Mortgages for Non-Residents: Our Detailed Guide.

- Mortgage rates comparison between all European countries, and why Spain as advantages…

- Your definitive guide to your Spanish mortgage

- Our ultimate mortgage calculator

- Is it easy to get a Spanish mortgage as a foreigner in a post-COVID-19 world?

- How do I choose between fixed and variable rates for a mortgage?

All our interactive charts in this article are available in a downloadable format

The average Spanish mortgage loan-to-value ratio is 64% in 2025, recovering from recent dips but still below 2019 peaks. Data shows banks’ willingness to finance property purchases has stabilised after pandemic-era fluctuations.

Spanish banks show remarkable lending restraint in 2025, with just 8.6% of mortgages financing above 80% of property value, down sharply from 15% in 2020. This conservative approach protects the banking sector and homebuyers from overleveraging in Spain’s robust but carefully regulated property market.

Spanish Bank Financing Costs_ 10-Year Bond Yields vs. Euribor Rates (2020-2025)

Line graph showing the average size of a mortgage in Spain from 01/2019 to 05/2023, peaking sharply in early 2020 and ending at €152,000—an essential trend for those tracking Spanish mortgage rates for non-residents.

Spanish mortgage activity showed robust 11% growth in 2024, with 423,741 new loans issued against 636,909 property sales. While still below the 2022 peak, the upward trend and 67% mortgage utilisation rate indicate renewed confidence in Spain’s real estate financing market following the 2023 contraction.

Line graph compares percentages of fixed and variable rate mortgages in Spain, highlighting a shift toward fixed rates around 2022. Annotations indicate inflation, interest rates, and trends in Spanish mortgage rates in 2025.

Spanish mortgage durations have steadily lengthened since 2020, reaching an average of 25 years in 2025. While shorter than the 30-year standard in some countries, this represents a gradual extension of loan terms in Spain’s property market, which may help buyers manage their monthly payments despite rising property values.

This image shows a comprehensive chart of Spanish mortgage rate trends through July 2025. The main chart displays multiple colored lines tracking different mortgage rate types over approximately 6 years (from around 2019 to 2025): – **Blue line**: Average mortgage rates – **Red/orange line**: Variable mortgage rates – **Purple line**: Fixed mortgage rates – **Yellow/gold line**: Shows inflation rate (which appears more volatile, with a notable spike around 2022) **Current rates highlighted on the right side:** – Fixed rate: 3.04% – Average rate: 2.98% – Variable rate: 2.87% – Inflation rate: 2.20%

FAQ Spanish mortgage rates

What is the current mortgage rate in Spain?

As of July 2025, Spanish mortgage rates average 2.98%. Fixed-rate mortgages are 3.04%, while variable rates are 2.87%. These are near historic lows, making Spain attractive for property investment.

Are mortgage rates going down in Spain?

Spanish mortgage rates have stabilized near historic lows after declining from 2023 peaks. Current rates around 2.98% are 0.5% below 2024 levels, with ECB policy supporting continued stability through 2025.

Can you get a fixed-rate mortgage in Spain?

Yes, 67% of Spanish mortgages are fixed-rate, averaging 3.04% for July 2025. Fixed rates offer payment certainty over 20-25 years and are popular with foreign buyers seeking stability.

How much deposit do I need for a Spanish mortgage?

Non-residents need a 30% minimum deposit as Spanish banks finance maximum 70% of property value. Residents may qualify for up to 80% financing, requiring just 20% deposit.

Can foreigners get a mortgage in Spain?

Yes, foreigners can get Spanish mortgages up to 70% of property value. Requirements include NIE number, proof of income, employment contract, and bank statements from your home country.

What documents do I need for a Spanish mortgage?

Essential documents include passport, NIE number, last 3 payslips, employment contract, bank statements, proof of assets/debts, and property purchase contract. Processing typically takes 4-6 weeks.

Which is better: fixed or variable mortgage in Spain?

Fixed-rate mortgages (3.04%) offer stability and are 0.17% higher than variable rates (2.87%). Most foreign buyers choose fixed rates for predictable payments despite slightly higher cost.

How long does a Spanish mortgage application take?

Spanish mortgage approval takes 4-8 weeks from application. Pre-approval can be obtained in 1-2 weeks. Having NIE number and documents ready speeds the process significantly.

What are Spanish mortgage costs and fees?

Total mortgage costs include arrangement fees (0.5-1%), valuation (€300-600), notary fees (€600-1,200), and registration costs (0.1-0.3% of property value). Budget 2-3% of property value for total costs.

Can I get a Spanish mortgage for investment property?

Yes, non-residents can get mortgages for Spanish investment properties with 30% deposit. Rental income can support applications, with banks typically requiring 70% loan-to-value maximum.

Are Spanish mortgage rates competitive in Europe?

Spanish mortgage rates at 2.98% average are competitive with Germany (3.1%) and France (3.2%). Combined with strong property markets in Madrid and Barcelona, Spain offers attractive financing.

Here are the statistics for earlier years:

-

-

-

-

The Spanish mortgage rates situation for December 2021

-

- Average mortgage has an interest rate of 2.53%

- The lowest rate ever was 2.44% reached in Nov 2020!

- The average mortgage duration is 24 years

- 32% have variable interest rates

- 68% have fixed interest rates

- The average rate for variable rate mortgages is 2.08%,

- The average rate for fixed-rate mortgages is 2.8%,

- The average amount issued per mortgage is €145,500: an increase of 1.9% vs last year.

- 32,905 mortgages were issued +23% vs last year.

- 4,8 € Bn of mortgages issued for housing in December 2021, +32% vs last year.

The top 3 regions with the biggest increases for the number of mortgages issued (Monthly):

-

-

- Aragon, +33% to 1.159 mortgages

- Extremadura, +29% to 683 mortgages

-

The top region in terms of amounts of mortgages issued (Annual)

-

- Balears, 211m€, +116%

- La Rioja, 19m€, +77%

- Aragon, 169m€, +70%

-

-

-

-

The Spanish mortgage rates situation for October 2021

-

-

-

-

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.48%

- The lowest rate ever was 2.44% reached in Nov 2020!

- The average mortgage duration is 24 years

- 33% have variable interest rates

- 67% have fixed interest rates

- The average rate for variable rate mortgages is 2.11%,

- The average rate for fixed-rate mortgages is 2.7%,

- The average amount issued per mortgage is €137,900: an increase of 1.9% vs last year.

- 33,105 mortgages were issued +67% vs last year.

- 4,6 € Bn of mortgages issued for housing in August 2021, +70% vs last year.

-

-

-

-

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued (Monthly):

-

-

-

-

-

-

-

-

-

-

-

-

- Navarra, +77% to 510 mortgages

- Murcia, +7% to 1,099 mortgages

- Andalusia, +2% to 6,589 mortgages

-

-

-

-

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued (Annual)

-

-

-

-

-

-

-

-

-

-

-

-

- Madrid, 1.2bn€, +89%

- Andalusia, 793m€, +89%

- Catalonia, 863m€, +87%

-

-

-

-

-

-

-

-

-

-

The Spanish mortgage rates situation for February 2021

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.49%

- The lowest rate ever was 2.44% reached in Nov 2020!

- The average mortgage duration is 24 years

- 47.3% have variable interest rates

- 52.7% have fixed interest rates

- The average rate for variable rate mortgages is 2.16%,

- The average rate for fixed-rate mortgages is 2.88%,

- The average amount issued per mortgage is €131,380: an decrease of 13.8% vs last year.

- 31,647 mortgages were issued -23.1% vs last year.

- 4,1 € Bn of mortgages issued for housing in February 2021, -29.9% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued (Monthly):

-

-

-

-

-

-

-

-

- Murcia, +45% to 1007 mortgages

- La Rioja, +40% to 215 mortgages

- Valencian Community, +24% to 3600 mortgages

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued (Annual)

-

-

-

-

-

-

-

-

- Navarra, 54m€, +19%

- La Rioja, 18m€, +16%

- Gallicia, 116m€, +13%

-

-

-

-

-

-

-

-

-

The Spanish mortgage rates situation for January 2021

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.47%

- The lowest rate ever was 2.44% reached in Nov 2020!

- The average mortgage duration is 24 years

- 48.8% have variable interest rates

- 51.2% have fixed interest rates

- The average rate for variable rate mortgages is 2.17%,

- The average rate for fixed-rate mortgages is 2.81%,

- The average amount issued per mortgage is €129,003: an increase of 13.5% vs last year.

- 27,518 mortgages were issued -31.6% vs last year.

- 3,5 € Bn of mortgages issued for housing in January 2021, -22.4% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued (Monthly):

-

-

-

-

-

-

-

-

- Navarra, +63% to 458 mortgages

- Balears, +27% to 643 mortgages

- La Rioja, +24.4% to 153 mortgages

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued (Annual)

-

-

-

-

-

-

-

-

- Cantabria, 40m€, +0%

- Catalonia, 758m€, -7%

- Castilla y Leon, 126m€, -9%

-

-

-

-

-

-

-

-

-

The Spanish mortgage rates situation for December 2020

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.53%

- The lowest rate ever was 2.44% reached in Nov 2020!

- The average mortgage duration is 24 years

- 51.6% have variable interest rates

- 48.4% have fixed interest rates

- The average rate for variable rate mortgages is 2.20%,

- The average rate for fixed-rate mortgages is 2.97%,

- The average amount issued per mortgage is €135,658: an increase of 9.2% vs last year.

- 26,128 mortgages were issued -14.8% vs last year.

- 3,5 € Bn of mortgages issued for housing in December 2020, -7% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued (Monthly):

-

-

-

-

-

-

-

-

- Cantabria, +9.3% to 354 mortgages

- Extremadura, +4.8% to 551 mortgages

- Aragon, +0.2% to 862 mortgages

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued (Annual)

-

-

-

-

-

-

-

-

- Aragon, 111m€, +62%

- Castilla y Leon, 118m€, + 38%

- Galicia, 123m€, +34%

-

-

-

-

-

-

-

-

-

The Spanish mortgage rates situation for November 2020

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.45%

- The lowest rate ever was 2.44% reached in Nov 2020!

- The average mortgage duration is 24 years

- 52.6% have variable interest rates

- 47.4% have fixed interest rates

- The average rate for variable rate mortgages is 2.05%,

- The average rate for fixed-rate mortgages is 2.86%,

- The average amount issued per mortgage is €136,676: an increase of 5.5% vs last year.

- 28,756 mortgages were issued +2.4% vs last year.

- 3,9 € Bn of mortgages issued for housing inNovember 2020, +3% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued (Monthly):

-

-

-

-

-

-

-

-

- Pais Vasco, +19% to 1729 mortgages

- Cantabria, +16% to 324 mortgages

- Catalonia, +15% to 4711 mortgages

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued (Annual)

-

-

-

-

-

-

-

-

- Castilla – La Mancha, 115m€, +32%

- Aragon, 97m€, +31%

- Galicia, 104m€, +21%

-

-

-

-

-

-

-

-

-

The Spanish mortgage rates situation for October 2020

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.47%

- The lowest rate ever was 2.44% reached in Nov 2020!

- The average mortgage duration is 25 years

- 51.1% have variable interest rates

- 48.9% have fixed interest rates

- The average rate for variable rate mortgages is 2.19%,

- The average rate for fixed-rate mortgages is 2.85%,

- The average amount issued per mortgage is €134,900: an increase of 4.6% vs last year.

- 28,248 mortgages were issued -5.9% vs last year.

- 3,8 € Bn of mortgages issued for housing in October 2020, -1.6% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued (Monthly):

-

-

-

-

-

-

-

-

- Castilla y Leon, +28% to 1226 mortgages

- La Rioja, +26% to 179 mortgages

- Navarra, +21% to 332 mortgages

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued (Annual)

-

-

-

-

-

-

-

-

- Extremadura, 40m€, +29%

- Aragon, 93m€, +23%

- Asturias, 46m€, +19%

-

-

-

-

-

-

-

-

-

The Spanish mortgage rates situation for September 2020

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.44%

- The lowest rate ever was 2.44% reached in Nov 2019!

- The average mortgage duration is 24 years

- 51.5% have variable interest rates

- 48.5% have fixed interest rates

- The average rate for variable rate mortgages is 2.12%,

- The average rate for fixed-rate mortgages is 2.84%,

- The average amount issued per mortgage is €135,035: a decrease of 1% vs last year.

- 26,878 mortgages were issued 18.4% vs last year.

- 3,6 € Bn of mortgages issued for housing in September 2020, +17.2% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued:

-

-

-

-

-

-

-

-

- Madrid, +66% to 5,077 mortgages

- Balearic Islands, +63% to 823 mortgages

- Catalonia, +42.4% to 3,968 mortgages

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued

-

-

-

-

-

-

-

-

- Extremadura, 51m€, +220%

- La Rioja, 13m€, +106%

- Cantabria, 39m€, +106%

- Asturias, 55m€, +105%

-

-

-

-

-

-

-

-

-

The Spanish mortgage rates situation for August 2020

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.49% (vs 2.54% last month)

- The lowest rate ever was 2.47% reached in Nov 2019!

- The average mortgage duration is 24 years

- 50.6% have variable interest rates

- 49.4% have fixed interest rates

- The average rate for variable rate mortgages is 2.18%,

- The average rate for fixed-rate mortgages is 2.87%,

- The average amount issued per mortgage is €134,700: an increase of 4% vs last year.

- 19,825 mortgages were issued -3% vs last year.

- 3,7 € Bn of mortgages issued for housing in August 2020, +0.5% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued:

-

-

-

-

-

-

-

-

- Navarra, +32% to 286 mortgages

- Castilla – La Mancha, +15% to 981 mortgages

- Cantabria, +12% to 279 mortgages

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued

-

-

-

-

-

-

-

-

- La Rioja, 15m€, +145%

- Canarias, 126m€, +91%

- Castilla – La Mancha, 94m€, +49%

- Extremadura, 33m€, +34%

-

-

-

-

-

-

-

-

The Spanish mortgage rates situation for July 2020

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.54% (vs 2.49% last month)

- The lowest rate ever was 2.47% reached in Nov 2019!

- The average mortgage duration is 23 years

- 47.5% have variable interest rates

- 52.5% have fixed interest rates

- The average rate for variable rate mortgages is 2.27%,

- The average rate for fixed-rate mortgages is 2.86%,

- The average amount issued per mortgage is €132,346: an increase of 8.9% vs last year.

- 26,014 mortgages were issued -23% vs last year.

- 3,4 € Bn of mortgages issued for housing in July 2020, -16% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued:

-

-

-

-

-

-

-

-

- La Rioja, +51% to 202 mortgages

- Canarias, +45% to 1,221 mortgages

- Valencian community, +31% to 3,341 mortgages

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued

-

-

-

-

-

-

-

-

- Basque Country, 282m€, +33%

-

-

-

-

-

-

-

-

The Spanish mortgage rates situation for June 2020

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.5% (vs 2.49% last month)

- The lowest rate ever was 2.47% reached in Nov 2019!

- The average mortgage duration is 23 years

- 54% have variable interest rates

- 46% have fixed interest rates

- The average rate for variable rate mortgages is 2.11%,

- The average rate for fixed-rate mortgages is 2.96%,

- The average amount issued per mortgage is €131,670: an increase of 7.5% vs last year.

- 26,748 mortgages were issued -13% vs last year.

- 3,5 € Bn of mortgages issued for housing in June 2020, -6% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- Basque Country, +129% to 2,811 mortgages

- Extremadura, +79% to 562 mortgages

- Murcia, +59% to 798 mortgages

-

-

-

-

-

-

-

The top regions in terms of amounts of mortgages issued are (change vs 1 year ago):

-

-

-

-

-

-

-

-

- Basque Country, 366m€, +95%

- Extremadura, 45m€, +85%

- Murcia, 68m€, +57%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in May 2020

Best mortgage conditions in Spain?

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.49% (vs 2.48% last month)

- The lowest rate ever was 2.47% reached in Nov 2019!

- The average mortgage duration is 23 years

- 50.5% have variable interest rates

- 49.5% have fixed interest rates

- The average rate for variable rate mortgages is 2.11%,

- The average rate for fixed-rate mortgages is 3%,

- The average amount issued per mortgage is €127,145: an increase of 3.2% vs last year.

- 25,538 mortgages were issued -27% vs last year.

- 3.2 € Bn of mortgages issued for housing in May 2020, -29% vs last year.

-

-

-

-

-

-

-

The top regions with the biggest increases for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- Andalusia, +6.8% to 5,580 mortgages

- Basque Country, +6.5% to 1,221 mortgages

- Galicia, +6.4% to 820 mortgages

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued are (change vs 1 year ago):

-

-

-

-

-

-

-

-

- Murcia, 56.8 M€, +22%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in April 2020

Best mortgage conditions in Spain?

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.48% (vs 2.56% last month)

- The lowest rate ever was 2.47% reached in Nov 2019!

- The average mortgage duration is 24 years

- 48.4% have variable interest rates

- 51.6% have fixed interest rates

- The average rate for variable rate mortgages is 2.13%,

- The average rate for fixed-rate mortgages is 2.86%,

- The average amount issued per mortgage is €125,300: an decrease of 1.2% vs last year.

- 23,840 mortgages were issued -18% vs last year.

- 3 € Bn of mortgages issued for housing in April 2020, -19% vs last year.

-

-

-

-

-

-

-

The 3 regions with the biggest decreases for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- Andalusia, +6.8% to 5,580 mortgages

- Basque Country, +6.5% to 1,221 mortgages

- Galicia, +6.4% to 820 mortgages

-

-

-

-

-

-

-

The top region in terms of amounts of mortgages issued are (change vs 1 year ago):

-

-

-

-

-

-

-

-

- Murcia, 56.8 M€, +22%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in March 2020

Best mortgage conditions in Spain?

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.56%

- The lowest rate ever is 2.47% reached in November 2019!

- The average mortgage duration is 23 years

- 47% have variable interest rates

- 53% have fixed interest rates

- The average rate for variable rate mortgages is 2.21%,

- The average rate for fixed-rate mortgages is 2.92%,

- The average amount issued per mortgage is €127,888: an increase of 1.6% vs last year.

- 26,382 mortgages were issued -15% vs last year.

- 3.4 € Bn of mortgages issued for housing in March 2020, -13% vs last year.

-

-

-

-

-

-

-

The top region with the biggest increases for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- La Rioja, +44% to 254 mortgages

-

-

-

-

-

-

-

The top 3 regions in terms of amounts of mortgages issued are (change vs 1 year ago):

-

-

-

-

-

-

-

-

- Aragon, 93 M€, +48%

- Asturias, 57 M€, +24%

- Cantabria, 34M€, +8%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in February 2020

Best mortgage conditions in Spain?

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.64% (vs 2.55% last month)

- The lowest rate ever is 2.47% reached in November 2019!

- The average mortgage duration is 23 years

- 62% have variable interest rates

- 37% have fixed interest rates

- The average rate for variable rate mortgages is 2.47%

- The average rate for fixed-rate mortgages is 3.02%

-

-

-

-

-

-

-

The 3 regions with the biggest decreases for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- Navarre, -45% to 373 mortgages

- Asturias, -38% to 694 mortgages

- Canary Islands, -31% to 1.035 mortgages

-

-

-

-

-

-

-

The top 3 regions in terms of amounts of mortgages issued are (change vs 1 year ago):

-

-

-

-

-

-

-

-

- Catalonia, 2.378 M€, +200%

- Andalusia, 1.109 M€, +57%

- Aragon, +30%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in January 2020

Best mortgage conditions in Spain?

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.55% (vs 2.53% last month)

- The lowest rate ever is 2.47% reached in November 2019!

- The average mortgage duration is 22 years

- 58% have variable interest rates

- 42% have fixed interest rates

- The average rate for variable rate mortgages is 2.22%

- The average rate for fixed-rate mortgages is 3.05%

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- Balearic Islands, +144% to 1.494 mortgages

- Asturias, +134% to 1.120 mortgages

- Castilla y Leon, +111% to 1.884 mortgages

-

-

-

-

-

-

-

The top 3 regions in terms of amounts of mortgages issued are (change vs 1 year ago):

-

-

-

-

-

-

-

-

- La Roja, 20 M€, +84%

- Navarre, 71 M€, +75%

- Balearic Islands, +74%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in December 2019

Best mortgage conditions in Spain?

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.53% (vs 2.47% last month)

- The average mortgage rate decreased by 5% vs 1 year ago

- The lowest rate ever is 2.47% reached in November 2019!

- The average mortgage duration is 23 years

- 56% have variable interest rates

- 44% have fixed interest rates

- The average rate for variable rate mortgages is 2.2%, 9.1% less than 1 year ago

- The average rate for fixed-rate mortgages is 3.06%, 2.6% more than 1 year ago

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- Castilla – La Mancha, +97% to 1.952 mortgages

- Canary Islands, +55% to 1.824 mortgages

- Madrid, +23% to 6.787 mortgages

-

-

-

-

-

-

-

The top 3 regions in terms of amounts of mortgages issued are (change vs 1 year ago):

-

-

-

-

-

-

-

-

- Castilla – La Mancha, 143 M€, +137%

- Madrid, 1.114 M€, +57%

- Canary Islands, +54%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in November 2019

Best mortgage conditions in Spain?

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.47% (vs 2.5% last month)

- The average mortgage rate decreased by 6.1% vs 1 year ago

- The lowest rate ever is the current rate 2.47%!

- The average mortgage duration is 24 years

- 57.3% have variable interest rates

- 42.7% have fixed interest rates

- The average rate for variable rate mortgages is 2.15%, 12.1% less than 1 year ago

- The average rate for fixed-rate mortgages is 3.01%, 0.3% more than 1 year ago

- The average amount issued per mortgage is €129,800: a decrease of 2.1% vs last year.

- 29,416 mortgages were issued -0.5% vs last year.

- 3.8 € Bn of mortgages issued for housing in October 2019, -0.9% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued are (monthly changes):

All the regions noticed a month on month decrease

Here are the most noticeable regions:

-

-

-

-

-

-

-

-

- Extremadura, +26.4% to 526 mortgages

- Cantabria, +13.6% to 376 mortgages

- Valencia Community, +12.8% to 3614 mortgages

-

-

-

-

-

-

-

The top 3 regions in terms of amounts of mortgages issued are (change vs 1 year ago):

-

-

-

-

-

-

-

-

- Extremadura, 48 M€, +72%

- Balearic Islands, 200 M€, +37%

- Cantabria, 43 M€, +36%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in October 2019

Best mortgage conditions in Spain?

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.50% (vs 2.51% last month)

- The average mortgage rate decreased by 5% vs 1 year ago

- The lowest rate ever is the current rate 2.50%!

- The average mortgage duration is 24 years

- 54.7% have variable interest rates

- 45.3% have fixed interest rates

- The average rate for variable rate mortgages is 2.09%, 11.2% less than 1 year ago

- The average rate for fixed-rate mortgages is 3.02%, 1.4% less than 1 year ago

- The average amount issued per mortgage is €129,000: a decrease of 2.1% vs last year.

- 29,691 mortgages were issued -1.1% vs last year.

- 3.8 € Bn of mortgages issued for housing in September 2019, -1.1% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued are (monthly changes):

All the regions noticed a month on month decrease

Here are the most noticeable regions:

-

-

-

-

-

-

-

-

- La Rioja, +127% to 186 mortgages

- Extremadura, +92% to 416 mortgages

- Cantabria, +80% to 331 mortgages

-

-

-

-

-

-

-

The top 5 regions in terms of amounts of mortgages issued are (change vs 1 year ago):

-

-

-

-

-

-

-

-

- Madrid, 936 M€, -12%

- Catalonia, 788 M€, -12%

- Andalusia, 660 M€, +8%

- Valencia Community, 327 M€, +20%

- Basque Country, 235 M€, +20%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in September 2019

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.51% (vs 2.55% last month)

- The average mortgage rate decreased by 3% vs 1 year ago

- The lowest rate ever is the current rate 2.51%!

- The average mortgage duration is 24 years

- 63.4% have variable interest rates

- 36.6% have fixed interest rates

- The average rate for variable rate mortgages is 2.13%, 9.3% less than 1 year ago

- The average rate for fixed-rate mortgages is 3.16%, 2.5% less than 1 year ago

- The average amount issued per mortgage is €135,452: a increase of 5.3% vs last year.

- 22,488 mortgages were issued -29.9% vs last year.

- 3 € Bn of mortgages issued for housing in August 2019, -29.9% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest increases for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- Navarre, +50% to 328 mortgages

- Madrid, +47% to 4,708 mortgages

- Castilla La Mancha, +26% to 897 mortgages

-

-

-

-

-

-

-

The top 5 regions in terms of amounts of mortgages issued are (change vs 1 year ago):

-

-

-

-

-

-

-

-

- Madrid, 936 M€, -27%

- Catalonia, 545 M€, -28%

- Andalusia, 463 M€, -29%

- Valencian Community, 255 M€, -29%

- Basque Country, 203 M€, -21%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in August 2019

-

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.55% (vs 2.56% last month)

- The average mortgage rate decreased by 3% vs 1 year ago

- The lowest rate ever is the current rate 2.55!

- The average mortgage duration is 23 years

- 60.7% have variable interest rates

- 39.3% have fixed interest rates

- The average rate for variable rate mortgages is 2.21%, 3.2% less than 1 year ago

- The average rate for fixed-rate mortgages is 3.18%, 1.5% more than 1 year ago

- 20,385 mortgages were issued -29.9% vs last year.

- The average amount issued per mortgage is €128,501: a increase of 5% vs last year.

- 2,6 € Bn of mortgages issued for housing in August 2019, -29.9% vs last year.

-

-

-

-

-

-

-

-

The top 3 regions with the biggest decreases for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- La Rioja, -72% to 74 mortgages

- Extremadura, -57% to 279 mortgages

- Castilla La Mancha, -53% to 714 mortgages

-

-

-

-

-

-

-

The top 3 regions with the biggest decreases in terms of amounts of mortgages issued are (yearly change):

-

-

-

-

-

-

-

-

- La Rioja, -65% to 6m issued

- Extremadura, -56% to 23m issued

- Canariasa, -45% to 66m issued

-

-

-

-

-

-

-

The Spanish mortgage rates situation in July 2019

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.56% (vs 2.57% last month)

- The average mortgage rate decreased by 1.2% vs 1 year ago

- The lowest rate ever is the current rate 2.56!

- The average mortgage duration is 23 years

- 58.1% have variable interest rates

- 41.9% have fixed interest rates

- The average rate for variable rate mortgages is 2.14%, 7.3% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.16%, 2.8% less than 1 year ago,

- The average amount issued per mortgage is €121,414: a decrease of 2,5% vs last year.

- 33,344 mortgages were issued +13.1% vs last year.

- 6,3 € Bn of mortgages issued for housing in July 2019, +15.2% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest growth for the number of mortgages issued are (monthly changes):

For a first time since long, all the regions suffer a month on month negative growth. The one with the smallest decreases are

-

-

-

-

-

-

-

-

- La Rioja, +79.3% to 269 mortgages

- Castilla La Mancha, +44% to 1,508 mortgages

- Asturias, +37% to 671 mortgages

-

-

-

-

-

-

-

The top 3 regions with the biggest growth in terms of amounts of mortgages issued are (yearly change):

-

-

-

-

-

-

-

-

- Extremadura, +45.9% to 652 mortgages

- Castilla La Mancha, +38% to 1,508 mortgages

- Castilla y Leon, +33.9% to 1,430 mortgages

-

-

-

-

-

-

-

The Spanish mortgage rates situation in June 2019

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.57% (vs 2.62% last month)

- The average mortgage rate decreased by 3% vs 1 year ago

- The lowest rate ever is 2.57!

- The average mortgage duration is 24 years

- 55.5% have variable interest rates

- 44.5% have fixed interest rates

- The average rate for variable rate mortgages is 2.29%, 6.1% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.01%, 1.3% less than 1 year ago,

- The average amount issued per mortgage is €119,964: a increase of 3,7% vs last year.

- 29,900 mortgages were issued -2.5% vs last year.

- 3,6 € Bn of mortgages issued for housing in May 2019, -6.1% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest growth for the number of mortgages issued are (monthly changes):

For a first time since long, all the regions suffer a month on month negative growth. The one with the smallest decreases are

-

-

-

-

-

-

-

-

- Region of Murcia, -2.6% to 824 mortgages

- Community of Navarra, -4.5% to 383 mortgages

- Basque country, -5.2% to 1,703 mortgages

-

-

-

-

-

-

-

The top 3 regions with the biggest growth in terms of amounts of mortgages issued are (yearly change):

-

-

-

-

-

-

-

-

- Community of Valencia, +16.9% to 3,748 mortgages

- Region of Murcia, +12% to 824 mortgages

- Basque country, +9.3% to 1,703 mortgages

-

-

-

-

-

-

-

The Spanish mortgage rates situation in May 2019

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.59% (same as last month)

- The average mortgage rate decreased by 2.9% vs 1 year ago

- The lowest rate ever is 2.57!

- The average mortgage duration is 24 years

- 56.8% have variable interest rates

- 43.2% have fixed interest rates (+6.7% vs last year)

- The average rate for variable rate mortgages is 2.3%, 5.1% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.09%, 1.8% less than 1 year ago,

- The average amount issued per mortgage is €124,700: a increase of 3.9% vs last year.

- 29,032 mortgages were issued -0.1% vs last year.

- 3.6 € Bn of mortgages issued for housing in April 2019, +0.6% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest growth for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- Community of Navarra, +45.3% to 510 mortgages

- Aragon, +19.7% to 814 mortgages

- Asturias, +11.9% to 556 mortgages

-

-

-

-

-

-

-

The Spanish mortgage rates situation in March 2019

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.62% (same as last month)

- The average mortgage rate decreased by 2.3% vs 1 year ago

- The lowest rate ever is 2.57!

- The average mortgage duration is 24 years

- 58.1% have variable interest rates

- 41.9% have fixed interest rates (+24.5% vs last year)

- The average rate for variable rate mortgages is 2.34%, 2.7% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.11%, 1.6% more than 1 year ago,

- The average amount issued per mortgage is €125,341: a increase of 3.9% vs last year.

- 30,716 mortgages were issued + 9.2% vs last year.

- 3.8 € Bn of mortgages issued for housing in March 2019, +20.3% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest growth for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- The Balearic Islands, +47% to 1,159 mortgages

- Andalusia, +17% to 6,069 mortgages

- Extremadura, +14% to 503 mortgages

-

-

-

-

-

-

-

The top 3 regions with the biggest growth in terms of amounts of mortgages issued are (yearly change):

-

-

-

-

-

-

-

-

- The Balearic Islands, +49% to 1,159 mortgages

- Extremadura, +36% to 503 mortgages

- Murcia, +31% to 503 mortgages

-

-

-

-

-

-

-

The Spanish mortgage rates situation in February 2019

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.62% (vs 2.57% last month)

- The average mortgage rate decreased by 1.1% vs 1 year ago

- The current rate: 2.62% is close to the lowest rate ever of 2.57!

- The average mortgage duration is 23 years

- 58.2% have variable interest rates

- 41.8% have fixed interest rates (+17.4% vs last year)

- The average rate for variable rate mortgages is 2.37%, 4% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.05%, 0.4% more than 1 year ago,

- The average amount issued per mortgage is €123,911: a increase of 2.9% vs last year.

- 31.018 mortgages were issued + 9.2% vs last year.

- 3.8 € Bn of mortgages issued for housing in February 2019, +12.3% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest growth for the number of mortgages issued are (monthly changes):

After a seasonally slower December, January looks even stronger vs December:

-

-

-

-

-

-

-

-

- Asturias, +24.9% to 728 mortgages

- Catalonia, +8.4% to 5.448 mortgages

- Pais Vasco, + 2.9% to 1.713 mortgages

-

-

-

-

-

-

-

The top 3 regions with the biggest growth in terms of amounts of mortgages issued are (yearly change):

-

-

-

-

-

-

-

-

- Asturias, +56% to 728 mortgages

- Castilla – La Mancha, +43% to 1.321 mortgages

- La Rioja, + 39% to 241 mortgages

-

-

-

-

-

-

-

The 6 regions with the biggest growth on the full year 2018

-

-

-

-

-

-

-

-

- The Valencian Community, +15.7% to 38.004 mortgages

- The Community of Madrid, +14.9% to 65.503 mortgages

- Castilla – La Mancha, +14.8% to 12.501 mortgages

- La Rioja, +13.5% to 2.332 mortgages

- The Community of Navarre, +13.4% to 4.615 mortgages

- Catalonia, +13% to 57.477 mortgages

- Extremadura, +12.3% to 5.550 mortgages

-

-

-

-

-

-

-

The 4 most active regions in 2018

No surprises, we keep the same regions as the most active ones in terms of transactions:

-

-

-

-

-

-

-

-

- The Community of Madrid, 65.503 mortgages with a growth of 14.9%

- The Andalusia, 65.431 mortgages with a growth of 8.6%

- Catalonia, 57.477 mortgages with a growth of 14.9%

- The Valencian Community, 38.004 mortgages with a growth of 15.7%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in January 2019

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.57% (vs 2.62% last month)

- The average mortgage rate decreased by 4.3% vs 1 year ago

- The current rate: 2.57% is the lowest rate ever!

- The average mortgage duration is 22 years

- 62.8% have variable interest rates

- 37.2% have fixed interest rates (+9.1% vs last year)

- The average rate for variable rate mortgages is 2.32%, 8% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.09%, 1.6% more than 1 year ago,

- The average amount issued per mortgage is €121,036: a decrease of -0.7% vs last year.

- 36.832 mortgages were issued + 22.5% vs last year.

- 4.4 € Bn of mortgages issued in January 2019, +21.6% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest growth for the number of mortgages issued are (monthly changes):

After a seasonally slower December, January looks even stronger vs December:

-

-

-

-

-

-

-

-

- Madrid Community, +168% to 10.478 mortgages

- Castilla – La Mancha, +101% to 1.485 mortgages

- Extremadura, + 76% to 542 mortgages

-

-

-

-

-

-

-

The top 3 regions with the biggest growth in terms of amounts of mortgages issued are (yearly change):

-

-

-

-

-

-

-

-

- Madrid Community, +105% to 10.478 mortgages

- Castilla – La Mancha, +25% to 1.485 mortgages

- Aragón, + 17% to 910 mortgages

-

-

-

-

-

-

-

The Spanish mortgage rates situation in December 2018

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.62% (vs 2.61% last month)

- The average mortgage rate decreased by 3.9% vs 1 year ago

- The lowest rate ever is 2.57%!

- The average mortgage duration is 24 years

- 58.6% have variable interest rates

- 41.4% have fixed interest rates (+9.1% vs last year)

- The average rate for variable rate mortgages is 2.42%, 4.7% less than 1 year ago,

- The average rate for fixed-rate mortgages is 2.98%, 4.8% less than 1 year ago,

- The average amount issued per mortgage is €126,394: an increased of 9.4% vs last year.

- 20.933 mortgages were issued + 0.9% vs last year.

- 2.6 € Bn of mortgages issued in December 2018, +10.4% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest growth for the number of mortgages issued are (monthly changes):

All the regions had a negative growth. Of course December is well known for being less busy all over the world.

The top 3 regions with the biggest growth in terms of amounts of mortgages issued are (yearly change):

-

-

-

-

-

-

-

-

- The Basque Country, +20.1% to 1.333 mortgages

- The Valencian Community, +17.3% to 2.456 mortgages

- Catalonia, +12% to 3.390 mortgages

-

-

-

-

-

-

-

The Spanish mortgage rates situation in November 2018

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.61% (vs 2.57% last month)

- The average mortgage rate decreased by 5.7% vs 1 year ago

- The lowest rate ever is 2.57%!

- The average mortgage duration is 23 years

- 64% have variable interest rates

- 36% have fixed interest rates (+25.9% vs last year)

- The average rate for variable rate mortgages is 2.42%, 0.7% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.07%, 14.1% less than 1 year ago,

- The average amount issued per mortgage is €130,651: an increased of 5.5% vs last year.

- 28.835 mortgages were issued + 14.2% vs last year.

- 5.6 € Bn of mortgages issued in November 2018, +13.7% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest growth for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- The Canary Islands, +39.4% to 1.299 mortgages

- The Balearic Islands, +17.8% to 899 mortgages

- Asturies, +4.7% to 532 mortgages

-

-

-

-

-

-

-

The top 3 regions with the biggest growth in terms of amounts of mortgages issued are (yearly change):

-

-

-

-

-

-

-

-

- The Canary Islands, +28.6% to 1.299 mortgages

- Catalonia, +25% to 5.363 mortgages

- The Valencian Community, +24.4% to 3.178 mortgages

-

-

-

-

-

-

-

The Spanish mortgage rates situation in October 2018

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.57% (vs 2.59% last month)

- The average mortgage rate decreased by 4.3% vs 1 year ago

- The lowest rate ever is 2.57%! YES, the current rate!

- The average mortgage duration is 24 years

- 60.4% have variable interest rates

- 39.6% have fixed interest rates (+25.9% vs last year)

- The average rate for variable rate mortgages is 2.43%, 2.9% less than 1 year ago,

- The average rate for fixed-rate mortgages is 2.99%, 3.7% less than 1 year ago,

- The average amount issued per mortgage is €126,926: an increased of 4.6% vs last year.

- 30.356 mortgages were issued + 20.4% vs last year.

- 5.8 € Bn of mortgages issued in October 2018, +13.9% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest growth for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- Navarra Community, +21.6% to 472 mortgages

- Catalonia, +10.7% to 5.808 mortgages

- Castilla y Leon, +4.8% to 1.153 mortgages

-

-

-

-

-

-

-

The top 3 regions with the biggest growth in terms of amounts of mortgages issued are (yearly change):

-

-

-

-

-

-

-

-

- Navarra Community, +53.7% to 472 mortgages

- Catalonia, +40.7% to 5.808 mortgages

- Aragon, +36.8% to 729 mortgages

-

-

-

-

-

-

-

The Spanish mortgage rates situation in September 2018

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.59% (vs 2.62% last month)

- The average mortgage rate decreased by 8.3% vs 1 year ago

- The lowest rate ever is 2.59%!

- The average mortgage duration is 24 years

- 59.9% have variable interest rates

- 40.1% have fixed interest rates (+16.7% vs last year)

- The average rate for variable rate mortgages is 2.36%, 10.8% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.02%, 5.9% less than 1 year ago,

- The average amount issued per mortgage is €127,732: an increased of 4.1% vs last year.

- 32.457 mortgages were issued + 9.5% vs last year.

- 6.6 € Bn of mortgages issued in September 2018, +10% vs last year.

-

-

-

-

-

-

-

The top 4 regions with the biggest growth for the number of mortgages issued are (monthly changes):

-

-

-

-

-

-

-

-

- Valencian Community, +32.5% to 3.863 mortgages

- Madrid, +30.6% to 6.530 mortgages

- Murcia, +21.5% to 866 mortgages

- Catalonia, +18.4% to 5.246 mortgages

-

-

-

-

-

-

-

The top 4 regions with the biggest growth in terms of amounts of mortgages issued are (yearly change):

-

-

-

-

-

-

-

-

- La Rioja, +123%

- Extremadura, +54%

- The community of Navarre, +37%

- Madrid, +28%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in August 2018

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.62% (vs 2.59% last month)

- The average mortgage rate decreased by 4.3% vs 1 year ago

- The lowest rate ever is 2.59%!

- The average mortgage duration is 24 years

- 59.8% have variable interest rates

- 40.2% have fixed interest rates

- The average rate for variable rate mortgages is 2.43%, 5.5% less than 1 year ago,

- The average rate for fixed-rate mortgages is 2.99%, 3.1% less than 1 year ago,

- The average amount issued per mortgage stands at €122,424, an increased of 9.8% vs last year.

- 28.755 mortgages were issued + 6.8% vs last year.

- 5.4 € Bn of mortgages issued in August 2018, +11% vs last year.

-

-

-

-

-

-

-

The top 4 regions with the biggest growth for the number of mortgages issued are:

-

-

-

-

-

-

-

-

- Extremadura, +31% to 604 mortgages

- The Canary Islands, +19,6% to 1.396 mortgages

- Cantabria, +16,4% to 326 mortgages

- Madrid, +13,9% to 5.000 mortgages

-

-

-

-

-

-

-

The top 4 regions with the biggest growth in terms of amounts of mortgages issued are:

-

-

-

-

-

-

-

-

- Extremadura, +61%

- Madrid, +29%

- Andalusia, +28%

- Basque country, +24%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in July 2018

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.59% (vs 2.63% last month)

- Average mortgage rate decreased by 6.3% vs 1 year ago

- The lowest rate ever is 2.59%! YES, the current rate reached this month!

- Mortgage duration is 22 years

- 62.3% have variable interest rates

- 37.7% have fixed interest rates

- The average rate for variable rate mortgages is 2.32%, 7.3% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.07%, 5.7% less than 1 year ago,

- The average amount issued per mortgage stands at €125,120, an increased of 2.1% vs last year.

- 29.287 mortgages were issued + 14.6% vs last year.

- 3.6 € Bn of mortgages issued in July 2018, +17% vs last year.

-

-

-

-

-

-

-

The top 4 regions with the biggest growth for the number of mortgages issued:

-

-

-

-

-

-

-

-

- Extremadura, +38.9% to 457 mortgages.

- The Valencian Community, +28.1% to 3.276 mortgages

- La Rioja, +28.1% to 283 mortgages

- Madrid, +27,5% to 5.713 mortgages

-

-

-

-

-

-

-

The top 4 regions with the biggest growth in terms of amounts of mortgages issued:

-

-

-

-

-

-

-

-

- La Rioja, +77.3%

- The region of Murcia, +43%

- Cantabria, +39.8%

- The Valencian Community, +39%

-

-

-

-

-

-

-

The Spanish mortgage rates situation in June 2018

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.63%

- Average mortgage rate decreased by 6.8% vs 1 year ago

- The lowest rate ever is 2.62% reached in March 2018

- Mortgage duration is 23 years

- 62.9% have variable interest rates

- 37.1% have fixed interest rates

- The average rate for variable rate mortgages is 2.19%, 11.3% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.25%, 0.5% more than 1 year ago,

- The average amount issued per mortgage stands at €123,896, an increased of 5.1% vs last year.

- 30.600 mortgages were issued + 3.9% vs last year.

-

-

-

-

-

-

-

The top 3 regions with the biggest mortgages growth:

-

-

-

-

-

-

-

-

- Madrid, +23,2% to 6.399 mortgages,

- Aragon, +10.6% to 957 mortgages,

- Extremadura, +18.4% to 616 mortgages.

-

-

-

-

-

-

-

The Spanish mortgage rates situation in May 2018

-

-

-

-

-

-

-

-

- Average mortgage has an interest rate of 2.63%

- Average mortgage rate decreased by 4.3% vs 1 year ago

- The lowest rate ever was 2.62% in March 2018

- Mortgage duration is 22 years

- 61.9% have variable interest rates

- 38.1% have fixed interest rates

- The average rate for variable rate mortgages is 2.4%, 9.8% less than 1 year ago,

- The average rate for fixed-rate mortgages is 3.12%, 6.6% more than 1 year ago,

- The average amount issued per mortgage stands at €117,044, an increased of 2.8% vs last year.

- 31.166 mortgages were issued + 7.3% vs last year.

-

-

-

-

-

-

-

While the top 4 regions in terms of annual growth were:

-

-

-

-

-

-

-

-

- The Canary Islands, +70,9% to 1.984 mortgages,

- Extremadura, +18.5% to 570 mortgages,

- Pais Vasco, +18.4% to 1.783 mortgages,

- Navarra, +17.3% to 441 mortgages

-

-

-

-

-

-

-

Check the Spanish report from the INE.

-

-

-