Reading time 6 minutes. Use our table of content for a quick read.

Reading time 6 minutes. Use our table of content for a quick read.

Last Updated on 17/07/2023 by STEPHANE

Click on any flag to get an automatic translation from Google translate. Some news could have an original translation here: News Nouvelles Nieuws Noticias Nachrichten

Follow this link if you are looking for the last update on the real estate prices for the top 20 Spanish cities.

Property investment in Spain: a very strong return of +11.2%

According to statistics released by the Central Bank of Spain in November 2022, the return expected on the residential Real Estate market in Spain is 11% and 8.4% if you take a mortgage – Green line on the chart. Not a bad property investment in Spain!

This performance comes from two sources:

- gross rental yield estimated at 3,6% –Blue line on the chart– and

- capital gain estimated at 7.6%.

Here is what we will cover in this article:

The Spanish real estate market has been strong since 2014

Sure Covid came to impact the market for the last three years to the end of 2021 but since 2022 here are the main evolutions:

As a reminder those are the trends that impacted the real estate markets worldwide post Covid:

-

- people are buying bigger, with more outside spaces and lights

- people are buying outside big cities

- foreigners are less active due to travel restrictions (but at HTBIS we could see a strong pick up in activity since the end of 2020)

Don’t miss our detailed quarterly report: The top 20 property markets in Spain

Now, we are fighting against a new “issue”… inflation. The good news is that the Spanish real estate market offers a nice hedge against inflation up to now and returns remain stron.

-

Spanish real estate return is back above 10% since May 2019

Of course, the uncertainty in the economy that came from Covid was noticeable in 2020 but since 2021, the market is rebounding strongly both in terms of transactions and prices. Have a look at our Spanish real estate quarterly report studying the property price evolution in all the top 20 regions of Spain for more.

Have a look at our interactive chart (yes when you come back, it will be updated). As you will see, property investment in Spain was wise since 2014.

-

Mortgage rates in Spain are rising since the start of 2022 at 2.9%

Yes, inflation is back, and so interest rates are rising. As of November 2022, mortgages rates were issued at 2.9% in Spain, Red line on the chart

Read our article updated every month with the current mortgage conditions, we have added many interesting statistics to follow as inflation levels: Find the best mortgage rate in Spain

We told you since 2020 that the risk was there for inflation spiking. Now, low mortgages are a history of the past but our view is that at the current levels of mortgages rates are still low. Another interesting thing to note is that real estate buyers are taking fixed-rate mortgages to finance their real estate purchases right now. Read more on that: Fixed or variable rates mortgage?

Have a quick look at our Spanish mortgage calculator if you want to know what is your purchasing power to buy a property in Spain:

The first real positive return since the crisis of 2008 came in early 2014 … six years ago…

As you can see on our chart, the estimated return became slightly positive for the second time since 2008 at the start of 2014. In 2010, the estimated return went slightly positive but it was not enough to compensate for the mortgage costs. The performance was much stronger in 2018 as the estimated profitability was higher than 10%. Right now, with close to 6%, the estimated profitability covers more than 3 times the current mortgage costs.

-

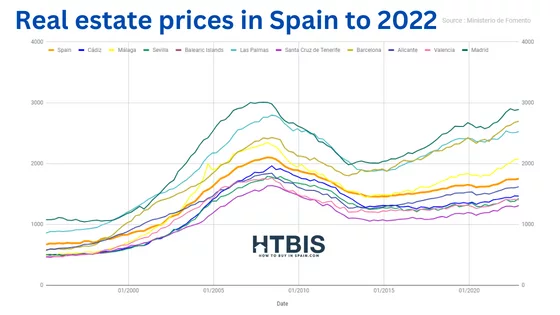

Real estate prices are lower than 10 years ago

Are there a lot of downsides to where we are here? Check the chart of real estate price evolution before and after 2007:

-

Spanish real estate returns have the second weakest performance in Europe on a 10-year time frame

Have a look at the comparison of the real estate market in Spain vs other European countries on any time frame between 3 months and 10 -year time frame

As you saw on this histogram, Spain has the weakest performance in a 10-year time frame. Click on the chart to check the performance for other period lengths.

-

Spanish Real Estate has the highest yields vs many European Cities

Discover the best new build projects in Spain available right now

Is Spanish property a good investment? Spain is in the sweet spot for a property investment if you check the real numbers!

If you want to know your property return for your Spanish property, you need to know a few data: your rental income before and after costs, your property prices and of course it is good to know the costs of your property including taxes. For more on that, read: the cost of owning a property in Spain and What are the taxes you have to pay on your Spanish property?

Buy to let? Spain offers some of the best returns in Europe:

- Madrid is in 7th place in Europe with a return of 3,9% and offers one of the best rental yields in Spain with more safety on your investment.

- Alicante took over the second place one of the best rental yields in Europe with a return of 4,6%, not bad

- Barcelona is the eleventh city in Europe with a yield of 2,2% according to Deloitte. Rents went down heavily in Barcelona for a few reasons, in 2020, the local authorities did introduce a cap on rents… while at the same time, the lockdown was quite strong, and a lack of demand from international businesses. We wouldn’t be surprised to see the yield come back up in the years to come.

Check the best rental Yields for the major European Cities, Madrid, and Alicante have rental yields close to 4%.

Barcelona and Madrid are the 5th and 8th most expensive European cities in terms of price/m²…

Have a look at our interactive chart

But check on the above chart, the price/m² in London is 7,916€/m² and 12.917€/m² in Paris… while Barcelona and Madrid are closer to 6.000€/m² and 5.000€/m².

You read it correctly: less than one-quarter and one-third of the price of London and Paris. Period.

Now, you understand why the returns in Madrid and Alicante are much higher than the ones in Paris and London.

Do you think that the downside risk is higher in Barcelona and Madrid than in Paris and London?

In the 2023 report from CBRE on European Investor Intentions, we find both Madrid and Barcelona in the top 6 as the best cities for real estate investors.

-

Real estate activity has strengthened since end of 2021 …post-Covid

Close to 95.000 properties were bought by foreigners in Spain in 2021 (12 months to September 2021) and more than 545.000 by Spaniards.

It looks like others agree with our conclusions…

Check for more information on our up-to-date pages on the Spanish national real estate market (prices and activity) and on the Spanish regional real estate markets (prices and activity).

If you want to have a deeper analysis, city per city, we would suggest reading our full report on that (click on the picture):

Here is as well our report on the Most active cities in Spain in 2019 (in terms of transactions).

-

Big uncertainty for the Spanish economic activity

Of course, we noticed a strong rebound in early 2020,… stopped by Covid. But activity in Spain is staying stronger than in most of the other European countries. What a roller coaster!

Check our up-to-date tables of a few Economic indicators in Spain:

But after this strong rebound, as everywhere in the world, we wait for the uncertainty to settle and the vaccines to allow more “normal” economic activity.

-

Financial markets will be more volatile

2018 with a year of higher volatility and negative returns in the financial markets. 2020 saw a huge spike in volatility due to Covid. Shortly after, the Central banks poured money to support economies.

Since 2022, we expect higher volatility in financial markets due to the change of policy from central banks all over the world. As of 2023, the interest rate curve is inverted, which signals a very high probability rate of an economic recession. Of course, a big unknown is how inflation numbers will come in the next years. The good news as of mid-2023 is that energy prices came back under the levels of early 2022 when the war started in Ukraine.

-

Spanish real estate outlook for 2023

As we wrote in our article, we are moderately optimistic about the outlook for the real estate market in Spain in 2023. While we have to admit that the comeback post-Covid of the Spanish real estate market (and everywhere in the world) was quicker and stronger than we expected. If we compare it to international markets, the rise is reasonable and not speculative. So, in our mind, we don’t see a real estate bubble here. The good news for international real estate cash-buyers: it should be easier to find properties as interest rates are rising.

-

How do we assist our customers to buy finding their dream homes in Spain?

Whether you’re looking for a holiday home or a permanent residence, all our local partners will help you to find the perfect property in their extensive selection of properties to suit your needs and budget. With a wealth of experience and knowledge, our team of real estate professionals are dedicated to helping you find your dream property in Spain.

But we’re not just here to help you find your perfect property. We also offer a range of services to make the buying process as smooth and hassle-free as possible. From legal advice to property management, we’ve got everything covered. Don’t hesitate to get in touch with our HTBIS team.

Have a look at our interesting articles:

- The 7 pitfalls of buying a property in Spain

- Top 10 reasons why we think that the Spanish market is a nice real estate opportunity right now. We bought ourselves in 2014,… and in 2019… let’s put our money where our words are 😉 .

- Spanish Real estate market vs the other European markets – Our quarterly update

- Madrid investment case study

- Barcelona investment case study

- Tenerife property investment case study

- Six reasons to love your property shopper

Looking for a local property hunter, a local lawyer, … any expert in Spain? Ask us directly!

Senior analyst and strategist at HTBIS

Check the full HTBIS team here

-

All our charts of this article are available here in a downloadable format

Property investment Spain

Calculate the return on your property investment in Spain

Foreigners’ real estate activity in Spain

Real estate prices and transactions in Spain

Source: Deloitte Property Index 2020, Overview of the European Residential Market

FAQ on the subject

Is it a good time to buy property in Spain 2023?

Yes, for sure, as you can see, prices are rising since 2014 but are far from the top of 2008. Returns are healthy and not excessive while financing remain low. Read more in our paper.

Are property prices in Spain falling?

No prices are not falling anymore in Spain. Real estate prices are rising since 2014 and remain far from the top: current average price per square meter in Spain is €1662 (end September 2021).

Can I get residency in Spain if I buy a house?

It depends if you are part of EU or not and if you have enough financial means to live. If you are not from EU countries, there are solutions, have a look at our article about the golden visa.

Where should I invest in real estate in Spain?

The top three markets in Spain offer interesting opportunities, Madrid, Valencia and Barcelona. At the same time many second tier cities are strong since the last two years