Reading time 17 minutes. Use our table of content for a quick read.

Reading time 17 minutes. Use our table of content for a quick read.

Last Updated on 18/06/2025 by STEPHANE

Spanish real estate price evolution up to March 2025: +9% Yr/Yr

Welcome to one of the most detailed resources available on Spanish property prices. Our quarterly report is the most detailed available on the Spanish real estate market, compiled with the insights of our 100+ local partners, in addition to our exclusive database. In this report, you will find all our resources on the 20 biggest Spanish real estate markets.

Spanish Property Market Reality Check: March 2025 – A Multi-Tier Surge Redefining Real Estate Investment

The Spanish property market has reached a pivotal moment that demands immediate attention from investors, buyers, and industry observers worldwide.

As we enter the second quarter of 2025, Spanish real estate has achieved something unprecedented since the post-2008 recovery began: a genuine multi-tier market surge that’s reshaping the entire investment landscape. With property prices reaching €2,033 per square meter—just 3% shy of the 2008 all-time peaks—we’re witnessing not merely another luxury market story, but a fundamental economic shift driving explosive activity across every price segment.

Market numbers tell us a story of a strong, not overheated market

For the first time since the recovery started, we’re seeing simultaneous growth across premium, mid-tier, and value markets. This isn’t speculation—it’s backed by hard data showing 739,075 property transactions in the past 12 months (a 15% increase) and remarkable year-on-year price growth of 9%, accelerating from just 7% three months earlier.

The driving forces? Of course, the strong Spanish economy, the strongest in the European region, is the main driving force. At the same time, the second driving force is the combination of low supply and high demand in both the sales and rental markets. We see a perfect storm of rising rental costs that’s making homeownership financially competitive at every price level, pushing Spanish families and international buyers alike into the purchase market in record numbers. Lower-tier markets are experiencing extraordinary transaction growth of +21.7% compared to +17% in premium segments—a clear indicator that this surge represents genuine, broad-based demand rather than speculative investment.

Crucially, despite this dramatic growth, Spanish property prices remain highly competitive compared to those in other major European markets, thereby maintaining Spain’s position as an exceptional value for international buyers.

Your Complete Guide to Spain’s transformed real estate market

This comprehensive analysis covers the most detailed examination of Spanish property prices across all major markets. Here’s what we’ll analyze:

Market Performance: Quarterly and annual price evolution, transaction volumes, and fastest-growing markets across all Spanish regions.

Investment Intelligence: Complete market rankings, historical context from 2008 peaks to 2014 lows, and long-term regional performance trends.

Strategic Insights: The three “winning regions” since 2014, detailed city-by-city analysis of the top 20 markets, and identification of sustainable growth versus speculative activity.

Future Outlook: Why this represents a structural shift in Spanish housing economics, opportunities across all price tiers, and strategic considerations for different buyer profiles.

Exclusive Market Intelligence: tailored opportunities for every Spanish Property Dream

Our exclusive analysis reveals surprising winners across all buyer categories that most investors are completely missing:

Holiday Home Seekers: While everyone fights over Málaga, our data reveals a coastal gem with 22% transaction growth that remains 10% below its 2008 peak, offering authentic Spanish charm at a more affordable price.

Investment-Minded Buyers: Forget Barcelona’s saturated rental market. Our analysis identifies an emerging university city where rental demand from locals who can no longer afford rent is driving a 29% increase in transactions. However, yes, you know it; we continue to love Barcelona, where we began our purchases in 2014.

Retirement Planners: The Balearics grab headlines, but our local partners have identified a Mediterranean lifestyle market where your Northern European pension stretches 40% further than five years ago.

Digital Nomads: Valencia gets all the attention, but we’ve uncovered a connected inland city with fiber infrastructure, co-working spaces, and mortgage payments that beat significant city rental costs.

Relocating Families: Our data show that Spanish families are choosing one particular region for homeownership over rental at record rates, creating ready-made international communities with authentic local integration.

Whether you’re seeking your dream Spanish property, evaluating investment opportunities, or understanding how this transformation affects existing holdings, this analysis provides the data-driven insights essential for navigating today’s dynamic Spanish property market.

The bargain basement days of 2014-2018 may be behind us, but Spain’s multi-tier surge has created new opportunities that savvy buyers and investors cannot afford to ignore.

-

Spanish property prices evolution over the last quarter

Let’s start with the Spanish national average for real estate: the price per square meter is €2,033 on average in Spain as of March 31, 2025. This means that Spanish real estate prices evolved

- by +9% in the previous year from €1,866/m² (+7% 3 months ago)

- by +3.1% during the last quarter (+2.7% 3 months ago)

Real estate prices in Spain have been on a strong recovery path since 2014. Of course, transactions were strong up to early 2020, the start of COVID-19. As the coronavirus crisis started, prices started to decrease in June 2020. Of course, due to the lockdowns and the coronavirus situation, transaction volume was lower in 2020; however, activity has returned since 2022 and remains strong. Over the last 12 months to March 2025, 739,075 properties were sold, representing a 15% year-on-year increase.

Please have a look at our interactive chart of the real estate prices in Spain over the last 30 years. In the same chart, you will find the property transaction history for each quarter. For most of our interactive charts, we produce a static chart that is easier to download.

On mobile, scroll left or right to see the whole chart.

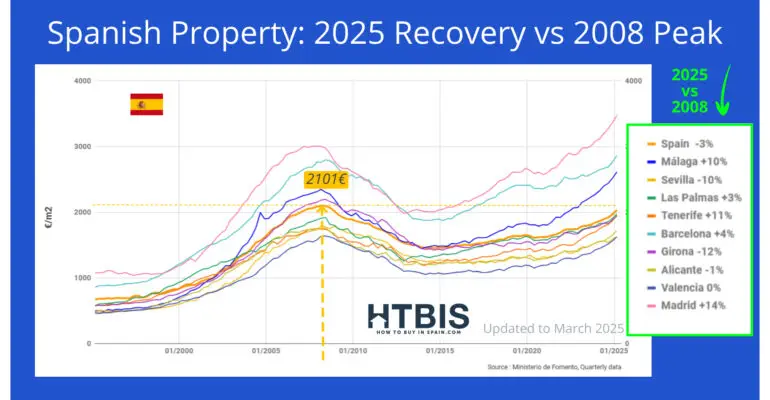

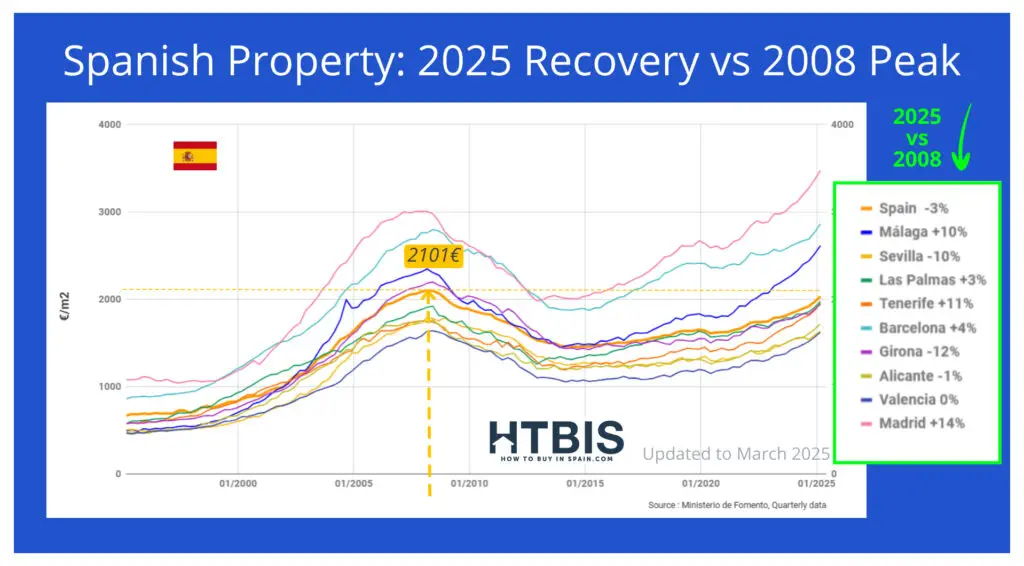

The lowest price reached since the 2007 financial crisis was €1,456/m² in the third quarter of 2014, while the highest was €2,101/m² in the first quarter of 2008. As of March 2025, we are just 3% of this level, and many markets are already above 2008 levels, as you can see in this chart:

Spain’s real estate price evolution from 1995 to 2025 by region, highlighting the recovery in 2025 compared to the 2008 peak.

What are the regions with the most significant increases and decreases?

The top performers for the Spanish real estate market over the last quarter are:

Sorted by price evolution in the previous 3 months, fourth column

On mobile, hold your device in a horizontal position if needed.

City / Region Price Yr Price Evolution Qtr Price Evolution Number of Transactions Transaction Evolution Burgos 1 269 € 6,3% 4,7% 6 123 14% Santa Cruz de Tenerife 1 957 € 12,0% 4,5% 12 860 5% Cuenca 843 € 8,6% 4,2% 2 888 22% Cantabria 1 773 € 10,0% 4,2% 10 600 19% Segovia 1 242 € 8,8% 4,0% 3 083 20% Canarias 1 966 € 9,9% 3,9% 27 358 6% Alicante/Alacant 1 722 € 10,3% 3,9% 57 698 8% Cádiz 1 754 € 9,8% 3,9% 18 355 13% Lleida 1 190 € 6,4% 3,9% 6 983 19% Toledo 1 050 € 10,8% 3,8% 15 021 19% Comunidad Valenciana 1 619 € 10,9% 3,8% 114 655 9% Coruña (A) 1 503 € 8,4% 3,8% 12 692 18% Soria 1 005 € 7,4% 3,7% 1 614 6% Murcia (Región de) 1 174 € 6,5% 3,7% 28 189 15% Ceuta 2 048 € 8,0% 3,7% 752 32% Málaga 2 614 € 12,3% 3,6% 39 187 12% Valencia/València 1 625 € 12,1% 3,6% 41 967 7% Balears (Illes) 3 436 € 13,2% 3,6% 15 904 6% Gipuzkoa 3 094 € 5,0% 3,6% 8 667 19% Barcelona 2 865 € 8,3% 3,5% 73 445 20% Palmas (Las) 1 976 € 7,9% 3,5% 14 498 7% Cataluña 2 453 € 8,3% 3,5% 113 033 18% Tarragona 1 581 € 7,4% 3,4% 17 701 16% Zaragoza 1 643 € 11,8% 3,4% 13 640 15% Guadalajara 1 460 € 11,3% 3,4% 5 407 7% Castilla-La Mancha 1 037 € 8,4% 3,4% 35 125 18% Salamanca 1 272 € 5,8% 3,3% 4 864 17% The worst-performing Spanish property markets over the last quarter are:

Sorted by price evolution in the previous 3 months, fourth column

City / Region Price Yr Price Evolution Qtr Price Evolution Number of Transactions Transaction Evolution Melilla 1 904 € -0,5% -0,6% 654 30% Cáceres 876 € 3,8% 0,3% 5 770 20% Extremadura 913 € 2,8% 0,9% 13 712 18% Ourense 977 € 4,3% 1,1% 3 479 21% Valladolid 1 391 € 5,8% 1,2% 7 731 21% Badajoz 940 € 2,1% 1,3% 7 942 16% Huesca 1 286 € 7,6% 1,3% 3 824 5% Jaén 826 € 3,6% 1,5% 8 377 28% Ceuta y Melilla 1 967 € 3,6% 1,5% 1 406 31% Zamora 851 € 4,5% 1,8% 2 373 22% Córdoba 1 162 € 3,2% 1,9% 11 238 20% Palencia 976 € 3,5% 2,2% 2 415 22% Huelva 1 332 € 4,7% 2,3% 8 652 13% Granada 1 423 € 10,7% 2,4% 16 193 19% Sevilla 1 631 € 5,2% 2,4% 26 568 22% León 938 € 3,7% 2,5% 6 853 29% Almería 1 307 € 7,3% 2,6% 16 365 16% Castilla y León 1 141 € 5,6% 2,6% 38 574 20% Navarra (Comunidad Foral de) 1 719 € 4,6% 2,8% 7 374 -2% Ávila 994 € 10,2% 2,9% 3 518 21%

Bar and line chart showing the evolution of Spain’s real estate prices among the country’s most moderate housing market performers in Q1 2025, with updated location-based price data through March 2025.

Here is the alphabetical ranking of all the regions’ real estate price evolution in the last quarter:

Interactive chart

-

Spanish property prices evolution over the last year

The Spanish cities with the most substantial real estate price increases for the year are:

Bar chart showing Spain real estate prices and price evolution percentages for various cities in Q1 2025; Madrid, Barcelona, and Palma de Mallorca lead with the highest property prices in Spain.

Sorted by price evolution over the last 12 months,

City / Region Price Yr Price Evolution Qtr Price Evolution Number of Transactions Transaction Evolution Balears (Illes) 3 436 € 13,2% 3,6% 15 904 6% Málaga 2 614 € 12,3% 3,6% 39 187 12% Valencia/València 1 625 € 12,1% 3,6% 41 967 7% Santa Cruz de Tenerife 1 957 € 12,0% 4,5% 12 860 5% Zaragoza 1 643 € 11,8% 3,4% 13 640 15% Madrid (Comunidad de) 3 477 € 11,5% 3,1% 89 252 17% Asturias (Principado de ) 1 519 € 11,4% 3,1% 17 731 23% Guadalajara 1 460 € 11,3% 3,4% 5 407 7% Aragón 1 495 € 11,1% 3,1% 19 549 13% Comunidad Valenciana 1 619 € 10,9% 3,8% 114 655 9% Toledo 1 050 € 10,8% 3,8% 15 021 19% Granada 1 423 € 10,7% 2,4% 16 193 19% Alicante/Alacant 1 722 € 10,3% 3,9% 57 698 8% Ávila 994 € 10,2% 2,9% 3 518 21% Cantabria 1 773 € 10,0% 4,2% 10 600 19% Canarias 1 966 € 9,9% 3,9% 27 358 6% Cádiz 1 754 € 9,8% 3,9% 18 355 13% Teruel 917 € 9,2% 2,9% 2 085 13% Andalucía 1 696 € 9,0% 3,0% 144 935 16% TOTAL NACIONAL 2 033 € 9,0% 3,1% 739 075 15% Segovia 1 242 € 8,8% 4,0% 3 083 20% Cuenca 843 € 8,6% 4,2% 2 888 22% Coruña (A) 1 503 € 8,4% 3,8% 12 692 18% Castilla-La Mancha 1 037 € 8,4% 3,4% 35 125 18% Barcelona 2 865 € 8,3% 3,5% 73 445 20% Cataluña 2 453 € 8,3% 3,5% 113 033 18% Ceuta 2 048 € 8,0% 3,7% 752 32% The worst-performing real estate markets for the year are:

Sorted by price evolution over the last 12 months, third column

City / Region Price Yr Price Evolution Qtr Price Evolution Number of Transactions Transaction Evolution Melilla 1 904 € -0,5% -0,6% 654 30% Badajoz 940 € 2,1% 1,3% 7 942 16% Extremadura 913 € 2,8% 0,9% 13 712 18% Córdoba 1 162 € 3,2% 1,9% 11 238 20% Ciudad Real 748 € 3,3% 3,1% 7 274 28% Palencia 976 € 3,5% 2,2% 2 415 22% Jaén 826 € 3,6% 1,5% 8 377 28% Ceuta y Melilla 1 967 € 3,6% 1,5% 1 406 31% León 938 € 3,7% 2,5% 6 853 29% Cáceres 876 € 3,8% 0,3% 5 770 20% Ourense 977 € 4,3% 1,1% 3 479 21% Zamora 851 € 4,5% 1,8% 2 373 22% Navarra (Comunidad Foral de) 1 719 € 4,6% 2,8% 7 374 -2% Huelva 1 332 € 4,7% 2,3% 8 652 13% Gipuzkoa 3 094 € 5,0% 3,6% 8 667 19% Sevilla 1 631 € 5,2% 2,4% 26 568 22% Bizkaia 2 628 € 5,3% 3,0% 13 941 24% País Vasco 2 716 € 5,5% 3,2% 26 730 21% Castilla y León 1 141 € 5,6% 2,6% 38 574 20% Salamanca 1 272 € 5,8% 3,3% 4 864 17% Rioja (La) 1 304 € 5,8% 3,3% 5 853 31% Albacete 1 063 € 5,8% 3,3% 4 535 12% Valladolid 1 391 € 5,8% 1,2% 7 731 21% Lugo 1 028 € 5,9% 3,1% 4 010 10% Burgos 1 269 € 6,3% 4,7% 6 123 14% Lleida 1 190 € 6,4% 3,9% 6 983 19% Murcia (Región de) 1 174 € 6,5% 3,7% 28 189 15% Almería 1 307 € 7,3% 2,6% 16 365 16% Galicia 1 436 € 7,3% 3,2% 29 095 18% Here is the Alphabetical ranking of all the regions’ real estate price evolution for the last year:

Interactive chart

-

Winners and Losers: Spanish Property Recovery vs 2008 Peak Analysis

One of the most revealing aspects of Spain’s current market position becomes clear when we compare today’s prices to the historic 2008 peak of € 2,101 per square meter. This analysis reveals a fascinating three-tier recovery pattern that defines today’s investment landscape.

The Clear Winners: Markets that have exceeded 2008 levels

Several Spanish markets have not only recovered but have pushed beyond their pre-crisis peaks, establishing new price records:

Premium Performers:

- Balearic Islands: +29.9% – The standout winner, nearly 30% above 2008 levels

- Madrid: +14% – The capital continues its premium trajectory

- Tenerife: +11% – Canary Islands showing strong international demand

- Málaga: +10% – Costa del Sol’s enduring appeal

These markets represent the new price ceiling for Spanish real estate, driven by sustained international demand, limited supply, and premium positioning.

The Recovery Zone: Markets at or near 2008 Levels

A significant group of markets has essentially reached full recovery, sitting within 5% of their 2008 peaks:

Full Recovery Markets:

- Valencia: 0% – Exactly at 2008 levels with growing momentum

- Alicante: -1% – Virtually complete recovery

- Barcelona: +4% – Just above peak levels

- Las Palmas: +3% – Canary Islands strength

These markets offer the psychological comfort of “proven” price levels while still providing growth potential as they move definitively above historic peaks.

The Value Opportunity: Markets still below 2008 peaks

The most intriguing opportunities lie in markets that remain significantly below their 2008 highs, yet show strong fundamental demand:

Value Plays with Upside Potential:

- Sevilla: -10% – Major city with 22% transaction growth

- Girona: -12% – Catalonian opportunity near French border

- Andalusia: -6.2% – Regional opportunity with lifestyle appeal

- Valencian Community: -4.1% – Broad regional recovery underway

Deep Value Markets:

- Castilla y León: -39.7% – Significant upside if national trends continue

- Murcia: -37.6% – Interior opportunities with affordability

- Extremadura: -42.6% – The deepest value play

Strategic Implications for 2025 and Beyond

For Premium Buyers: The winner markets (Balearics, Madrid, Málaga) offer proven resilience and continued growth, though at premium entry points.

For Value Investors: Markets like Sevilla (-10% from peak but +22% transaction growth) represent compelling combinations of value and momentum.

For Long-term Positioning: The 40 %+ discounts in Castilla y León and Murcia may represent generational opportunities if Spain’s economic growth continues.

The National Picture: With Spain overall just 3% below the 2008 peak, the country has essentially achieved full recovery while maintaining a better value than most European markets.

This recovery pattern validates our “multi-tier surge” thesis: different markets are at various stages of their cycles, creating opportunities across all investment strategies and price points.

-

The most expensive real estate markets in Spain

up to End March 2025 are sorted by price, the second column

Bar chart comparing Spain real estate prices and price evolution percentages in various cities as of March 2025, featuring the Spanish flag and highlighting spanish property prices 2025, with data source indicated.

City / Region Price Yr Price Evolution Qtr Price Evolution Number of Transactions Transaction Evolution Madrid (Comunidad de) 3 477 € 11,5% 3,1% 89 252 17% Balears (Illes) 3 436 € 13,2% 3,6% 15 904 6% Gipuzkoa 3 094 € 5,0% 3,6% 8 667 19% Barcelona 2 865 € 8,3% 3,5% 73 445 20% País Vasco 2 716 € 5,5% 3,2% 26 730 21% Bizkaia 2 628 € 5,3% 3,0% 13 941 24% Málaga 2 614 € 12,3% 3,6% 39 187 12% Cataluña 2 453 € 8,3% 3,5% 113 033 18% Araba/Alava 2 251 € 7,4% 3,1% 4 122 16% Ceuta 2 048 € 8,0% 3,7% 752 32% TOTAL NACIONAL 2 033 € 9,0% 3,1% 739 075 15% Palmas (Las) 1 976 € 7,9% 3,5% 14 498 7% Ceuta y Melilla 1 967 € 3,6% 1,5% 1 406 31% Canarias 1 966 € 9,9% 3,9% 27 358 6% Santa Cruz de Tenerife 1 957 € 12,0% 4,5% 12 860 5% Girona 1 943 € 7,9% 3,0% 14 904 7% Melilla 1 904 € -0,5% -0,6% 654 30% Cantabria 1 773 € 10,0% 4,2% 10 600 19% Cádiz 1 754 € 9,8% 3,9% 18 355 13% Alicante/Alacant 1 722 € 10,3% 3,9% 57 698 8% Navarra (Comunidad Foral de) 1 719 € 4,6% 2,8% 7 374 -2% Andalucía 1 696 € 9,0% 3,0% 144 935 16% with the National Spanish Average at 2,033 €/m².

-

The least expensive real estate markets in Spain

up to End March 2025 are, sorted by price, second column

City / Region Price Yr Price Evolution Qtr Price Evolution Number of Transactions Transaction Evolution Ciudad Real 748 € 3,3% 3,1% 7 274 28% Jaén 826 € 3,6% 1,5% 8 377 28% Cuenca 843 € 8,6% 4,2% 2 888 22% Zamora 851 € 4,5% 1,8% 2 373 22% Cáceres 876 € 3,8% 0,3% 5 770 20% Extremadura 913 € 2,8% 0,9% 13 712 18% Teruel 917 € 9,2% 2,9% 2 085 13% León 938 € 3,7% 2,5% 6 853 29% Badajoz 940 € 2,1% 1,3% 7 942 16% Palencia 976 € 3,5% 2,2% 2 415 22% Ourense 977 € 4,3% 1,1% 3 479 21% Ávila 994 € 10,2% 2,9% 3 518 21% Soria 1 005 € 7,4% 3,7% 1 614 6% Lugo 1 028 € 5,9% 3,1% 4 010 10% Castilla-La Mancha 1 037 € 8,4% 3,4% 35 125 18% Toledo 1 050 € 10,8% 3,8% 15 021 19% Albacete 1 063 € 5,8% 3,3% 4 535 12% Castilla y León 1 141 € 5,6% 2,6% 38 574 20% Córdoba 1 162 € 3,2% 1,9% 11 238 20% Murcia (Región de) 1 174 € 6,5% 3,7% 28 189 15% Lleida 1 190 € 6,4% 3,9% 6 983 19% Castellón/Castelló 1 233 € 7,3% 3,2% 14 990 24% Segovia 1 242 € 8,8% 4,0% 3 083 20% Burgos 1 269 € 6,3% 4,7% 6 123 14% Salamanca 1 272 € 5,8% 3,3% 4 864 17% Huesca 1 286 € 7,6% 1,3% 3 824 5% Rioja (La) 1 304 € 5,8% 3,3% 5 853 31% Almería 1 307 € 7,3% 2,6% 16 365 16% Huelva 1 332 € 4,7% 2,3% 8 652 13% Valladolid 1 391 € 5,8% 1,2% 7 731 21% Granada 1 423 € 10,7% 2,4% 16 193 19% with the National Spanish Average at 2,033 €/m².

-

The most active Spanish real estate markets

The real estate markets with the most transactions in Spain as of the end of March 2025, sorted by the number of transactions over the last 12 months, are listed in the fourth column.

City / Region Price Yr Price Evolution Qtr Price Evolution Number of Transactions Transaction Evolution TOTAL NACIONAL 2 033 € 9,0% 3,1% 739 075 15% Andalucía 1 696 € 9,0% 3,0% 144 935 16% Comunidad Valenciana 1 619 € 10,9% 3,8% 114 655 9% Cataluña 2 453 € 8,3% 3,5% 113 033 18% Madrid (Comunidad de) 3 477 € 11,5% 3,1% 89 252 17% Barcelona 2 865 € 8,3% 3,5% 73 445 20% Alicante/Alacant 1 722 € 10,3% 3,9% 57 698 8% Valencia/València 1 625 € 12,1% 3,6% 41 967 7% Málaga 2 614 € 12,3% 3,6% 39 187 12% Castilla y León 1 141 € 5,6% 2,6% 38 574 20% Castilla-La Mancha 1 037 € 8,4% 3,4% 35 125 18% Galicia 1 436 € 7,3% 3,2% 29 095 18% Murcia (Región de) 1 174 € 6,5% 3,7% 28 189 15% Canarias 1 966 € 9,9% 3,9% 27 358 6% País Vasco 2 716 € 5,5% 3,2% 26 730 21% Sevilla 1 631 € 5,2% 2,4% 26 568 22% Aragón 1 495 € 11,1% 3,1% 19 549 13% Cádiz 1 754 € 9,8% 3,9% 18 355 13% Asturias (Principado de ) 1 519 € 11,4% 3,1% 17 731 23% Tarragona 1 581 € 7,4% 3,4% 17 701 16% Almería 1 307 € 7,3% 2,6% 16 365 16% Granada 1 423 € 10,7% 2,4% 16 193 19% Balears (Illes) 3 436 € 13,2% 3,6% 15 904 6% Toledo 1 050 € 10,8% 3,8% 15 021 19% Castellón/Castelló 1 233 € 7,3% 3,2% 14 990 24%

Bar chart illustrating the number of real estate transactions and the evolution of real estate prices in major cities in Spain in March 2025, with Madrid and Barcelona leading.

-

The fastest-growing real estate markets in Spain

(or least decreasing in case evolution is negative)

Here are the real estate markets in Spain with the fastest growth in terms of transitions to the end of March 2025, sorted by transaction evolution over the last 12 months / fourth column

City / Region Price Yr Price Evolution Qtr Price Evolution Number of Transactions Transaction Evolution Ceuta 2 048 € 8,0% 3,7% 752 32% Ceuta y Melilla 1 967 € 3,6% 1,5% 1 406 31% Rioja (La) 1 304 € 5,8% 3,3% 5 853 31% Melilla 1 904 € -0,5% -0,6% 654 30% León 938 € 3,7% 2,5% 6 853 29% Jaén 826 € 3,6% 1,5% 8 377 28% Ciudad Real 748 € 3,3% 3,1% 7 274 28% Bizkaia 2 628 € 5,3% 3,0% 13 941 24% Castellón/Castelló 1 233 € 7,3% 3,2% 14 990 24% Asturias (Principado de ) 1 519 € 11,4% 3,1% 17 731 23% Pontevedra 1 565 € 7,3% 3,1% 8 914 22% Palencia 976 € 3,5% 2,2% 2 415 22% Zamora 851 € 4,5% 1,8% 2 373 22% Cuenca 843 € 8,6% 4,2% 2 888 22% Sevilla 1 631 € 5,2% 2,4% 26 568 22% Valladolid 1 391 € 5,8% 1,2% 7 731 21% País Vasco 2 716 € 5,5% 3,2% 26 730 21% Ourense 977 € 4,3% 1,1% 3 479 21% Ávila 994 € 10,2% 2,9% 3 518 21% Barcelona 2 865 € 8,3% 3,5% 73 445 20% Check this fascinating infographic comparing transaction growth, price per m², and price evolution over the last year:

Bar chart comparing Spain real estate prices and transaction trends in the most expensive markets, with data updated to March 2025, highlighting the evolution of Spanish property prices in 2025.

-

The least active property markets in Spain

Here are the Spanish cities registering the least transactions as of the end of March 2025, sorted by transaction evolution over the last 12 months/ third column

City / Region Price Yr Price Evolution Qtr Price Evolution Number of Transactions Transaction Evolution Navarra (Comunidad Foral de) 1 719 € 4,6% 2,8% 7 374 -2% Huesca 1 286 € 7,6% 1,3% 3 824 5% Santa Cruz de Tenerife 1 957 € 12,0% 4,5% 12 860 5% Soria 1 005 € 7,4% 3,7% 1 614 6% Balears (Illes) 3 436 € 13,2% 3,6% 15 904 6% Canarias 1 966 € 9,9% 3,9% 27 358 6% Girona 1 943 € 7,9% 3,0% 14 904 7% Valencia/València 1 625 € 12,1% 3,6% 41 967 7% Guadalajara 1 460 € 11,3% 3,4% 5 407 7% Palmas (Las) 1 976 € 7,9% 3,5% 14 498 7% Alicante/Alacant 1 722 € 10,3% 3,9% 57 698 8% Comunidad Valenciana 1 619 € 10,9% 3,8% 114 655 9% Lugo 1 028 € 5,9% 3,1% 4 010 10% Málaga 2 614 € 12,3% 3,6% 39 187 12% Albacete 1 063 € 5,8% 3,3% 4 535 12% Aragón 1 495 € 11,1% 3,1% 19 549 13% Huelva 1 332 € 4,7% 2,3% 8 652 13% Cádiz 1 754 € 9,8% 3,9% 18 355 13% Teruel 917 € 9,2% 2,9% 2 085 13% Burgos 1 269 € 6,3% 4,7% 6 123 14% Zaragoza 1 643 € 11,8% 3,4% 13 640 15% -

Price evolution of the most significant regions since 2006

2014 was the year when Spanish property prices reached their lowest point.

Here is a downloadable format of the chart if you want to save it:

Line graph showing the evolution of Spain’s real estate prices from 2000 to 2025 by region, highlighting the recovery in 2025 compared to the 2008 peak, with percentage changes for each city. Includes insights into Spanish property prices 2025.

As you can see on this chart, Spanish real estate prices (thick orange line) reached their lowest price point in early 2014 since the 2008 crisis. Since early 2014, real estate prices have been rising and reached 2,033€/m² by the end of March 2025. If you look at prices in general, yes, we can discuss growth again, but if you compare them to the levels of 2008 or European real estate prices, you can still find bargains.

The three winning regions since 2014

The Spanish market is divided into two groups since 2014: regions with rising prices, including Barcelona, Madrid, and the Balearic Islands, and all other areas where prices have stabilized or are increasing modestly. Since 2022, we have observed that nearly all Spanish regions have participated in this rally.

Is it easy to buy in Spain?

It is easy to buy a property in Spain, but:

- because you are not on the ground,

- because you don’t know the market and

- because you need to check your property in order to avoid any nasty surprises, we advise you not to do it alone.

We are foreigners and Spanish residents who have purchased properties in Spain, and we have developed a network of reliable partners to assist foreigners with their property purchases in Spain.

We wrote this detailed article to help you out: Our ultimate 2025 guide to buying your property in Spain, where you will get most of our tricks.

Don’t forget, if you are buying in Spain as a foreigner, you could have two different motives:

- Pleasure

- Investment

or the two combined. Depending on your motivation(s), your criteria will be different.

-

Price evolution since 1995 for the top 20 Spanish cities

We have created massive databases containing all this information, which is updated quarterly for all Spanish cities. For each of those, you will find the last quarterly prices and transaction data available. We did the same for each Spanish city: price and transaction information, an interactive chart (always up to date with our database), the resources available in the city, and an image of the real estate price evolution between 1995 and March 2025 (static and not updated).

Follow our alphabetical ranking or click on any name on this list: Alicante real estate prices, Almeria real estate prices, Barcelona real estate prices, Cadiz real estate prices, Castellón real estate prices, Girona real estate prices, Ibiza real estate prices, Las Palmas real estate prices, Madrid real estate prices, Málaga real estate prices, Murcia real estate prices, Sevilla real estate prices, Tenerife real estate prices, Valencia real estate prices, Valladolid real estate prices, Zaragoza real estate prices

Alicante real estate prices: €1,722 /m², +10.3% yr/yr

Real estate transactions for Alicante – last year: 57,698, +8%

Have a look at our interactive Alicante real estate price chart:

Real estate prices in Alicante remain, on average, 15% lower than the national average and nearly back to their 2008 pre-crisis levels.

Evolution of Alicante and Spain’s real estate prices from 1995 to March 2025, with Alicante at 1,722€ and Spain at 2,033€.

Have a look at the property hunting in Alicante realized by our local property hunter:- Have a look at the property hunting in Alicante realized by our local property hunter:

- Costa Blanca property investment: a holiday home in Calpe – Alicante,

- Costa Blanca property hunting: property investment and renovation in Altea

Here are our other resources on Alicante:

- Our article on Alicante: The best Spanish shopping experience you will find in Alicante, Barcelona, Madrid and Malaga! Alicante: the Spanish pearl

- Our article on the Costa Blanca: Everything you ever wanted to know about the Costa Blanca

- Check the monthly weather statistics for Alicante

- Check some of our experts in our local network in Alicante: Real estate Lawyers in Alicante, Property hunters in Alméria, Architects in Alicante, How to find a mortgage in Alicante? All the experts assist you in your language

- Find your local experts in Alicante within our network, it’s free!

Almeria property prices: €1,307 /m², +7.3% yr/yr

Transactions for the Almeria property market: 16,365 +16%

Have a look at our interactive Almeria real estate price chart:

Real estate prices in Almeria remain, on average, 33% lower than the national average and well below their 2008 pre-crisis levels.

Here are our local property hunters in Alméria.

Here are our other resources on Almería:

- Our article on Almeria: Almería, one of the Andalusian pearls

- Our article on the Costa de Almería: Everything you ever wanted to know about the Costa de Almería

- Check the monthly weather statistics for Alméria

- Check some of our experts in our local network in Alméria: Real estate Lawyers in Alméria, Property hunters in Alméria, Architects in Alméria, How to find a mortgage in Alméria? All the experts assist you in your language

- Find your local experts in Alméria within our network, it’s free!

Comparison of Spain real estate prices in Almeria and nationwide from 1995 to March 2025, with Almeria at 1,307€ and Spain at 2,033€.

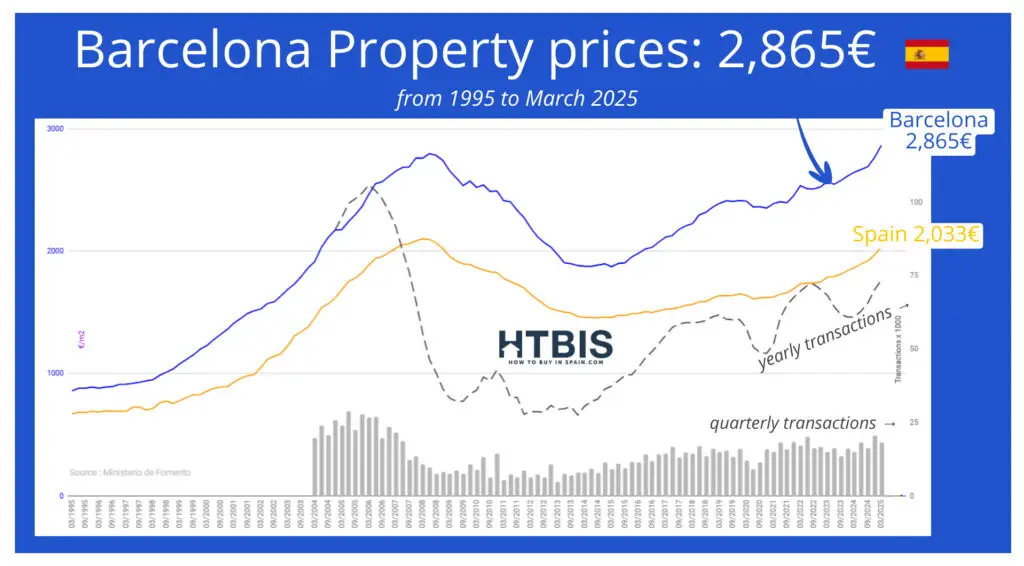

Barcelona real estate prices: €2,865 /m², +8.3% yr/yr

Transactions for the real estate market in Barcelona: 73,445 +20%

Have a look at our interactive Barcelona real estate price chart:

Real estate prices in Barcelona are, on average, 40% higher than the national average and are trading again at new all-time highs. Considering the number of transactions, Madrid and Barcelona are the two strongest markets.

Have a look at the property hunting in Barcelona, realized by our local property hunter:

- A countryside villa close to Barcelona and Tossa de Mar: Costa Brava property investment

- Barcelona property hunting: an apartment in Barcelona got a quick refresh for €15,000

- Barcelona property hunting: a Case study

Here are our other resources on Barcelona:

- Our article on Barcelona: Barcelona real estate market is rising in 2017

- Our article on the Costa de Barcelona: Everything you ever wanted to know about the Costa de Barcelona

- Check the monthly weather statistics for Barcelona

- Check our Citytrip ePostcards on Barcelona

- Check some of our experts in our local network in Barcelona: Real estate Lawyers in Barcelona, Property hunters in Barcelona, Architects in Barcelona, How to find a mortgage in Barcelona all assisting you in your language

- Find your local experts in Barcelona within our network, it’s free!

Spain’s real estate prices, compared to Barcelona property prices, are expected to rise to 2,865€ by March 2025, surpassing the national average of 2,033€.

Cadiz property prices: €1,754 /m², +9.8% yr/yr

Property transactions for Cadiz: 18,355 +13%

Have a look at our interactive Cadiz real estate price chart:

Real estate prices in Cadiz remain, on average, 15% lower than the national average and are 9% below highest levels reached in 2008.

- Our article on Cadiz: The real estate market in Cadiz, 2017

- Check out our infographic on the Costa de la Luz, which includes all the activities available there.

- Check the monthly weather statistics for Cadiz

- Check some of our experts in our local network in Cadiz: Real estate Lawyers in Cadiz, Property hunters in Cadiz, Architects in Cadiz, and How to find a mortgage in Cadiz, all assisting you in your language

- Find your local experts in Cadiz within our network, it’s free!

Spain real estate prices in Cádiz (1,754€) and nationwide (2,033€) from 1995 to March 2025.

Castellón, Castelló real estate prices: €1,233/m², +7.3% yr/yr

Real estate transactions for Castellón, Castelló: 14,4990 +24%

Have a look at our interactive Castelló real estate price chart:

Real estate prices in Castellón remain, on average, 35% lower than the national average and 40% lower than levels reached in 2008.

- Our article on Castellon: The Castellón real estate market resurrects but remains very attractive in 2017

- Our article on the Costa del Azahar: Everything you ever wanted to know about the Costa del Azahar

- Check the monthly weather statistics for Castellon

- Check some of our experts in our local network in Castellón: Real estate Lawyers in Castellón, Property hunters in Castellón, Architects in Castellón, and How to find a mortgage in Castellón all assisting you in your language

- Find your local experts in Castellón within our network, it’s free!

Spain real estate price (2,033€)evolution and transactions in Castellon (1,233€) and nationwide from 1995 to March 2025.

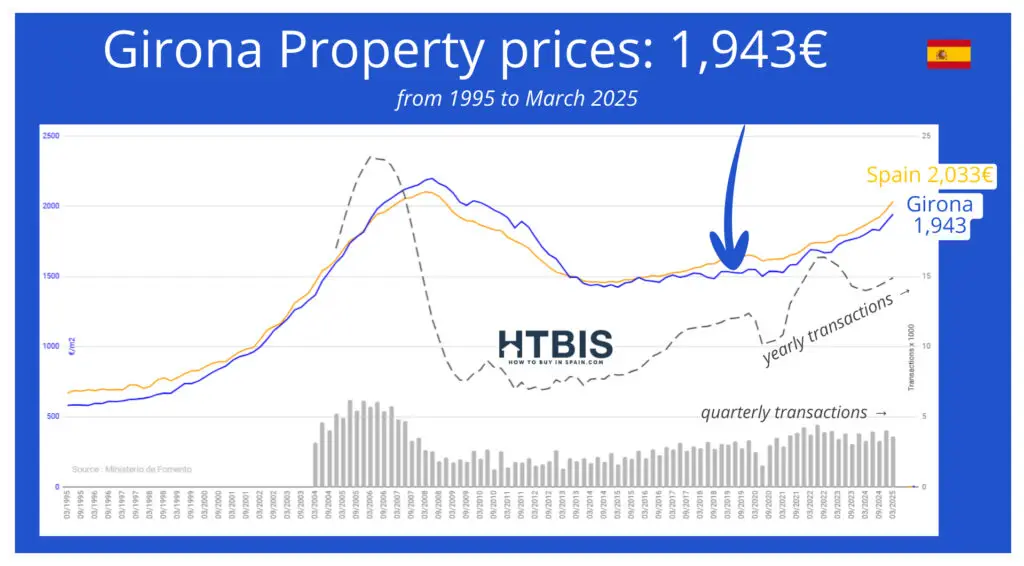

Girona property prices: €1,943/m², +7.9% yr/yr

Property transactions for the real estate market in Girona: 14,904 +7%

Have a look at our interactive Girona real estate price chart:

Real estate prices in Girona followed national prices as if Girona were the national market, which is an interesting phenomenon. Check these two charts! Girona is 10% lower than its top levels reached in 2008.

Have a look at the property hunting in Girona realized by our local property hunter:

- A countryside villa close to Barcelona and Tossa de Mar: Costa Brava property investment

- Costa Brava property hunting, a house in Begur.

- Costa Brava property investment: A sea-view apartment with pool in Platja d’Aro

- A mountain-view detached villa in Calonge: Costa Brava property investment

Here are our other resources on Girona:

- Our article on Girona: Girona, the door to the Pyrenees and the Costa Brava

- Our article on the Costa Brava: Everything you ever wanted to know about the Costa Brava.

- Check the monthly weather statistics for Girona

- Check some of our experts in our local network in Girona: Real estate Lawyers in Girona, Property hunters in Girona, Architects in Girona, How to find a mortgage in Girona all assisting you in your language

- Find your local experts in Girona within our network, it’s free!

Line graph of Girona (1,943€) property prices from 1995 to March 2025, illustrating the Spain real estate price evolution

Ibiza real estate prices/Balearic Islands: €3,436 /m², +13.2% yr/yr

Property transactions for the Balearic Islands are: 15,904 +6%

Have a look at our interactive Ibiza real estate price chart:

Real Estate prices in Mallorca are 70% higher than the national average and are 30% of their 2008 pre-crisis levels. Activity is strong and has returned to pre-COVID levels.

Looking for a property hunter in Ibiza? Here are our property hunters on the Balearic Islands

Don’t miss our other resources on Ibiza.

- Our article on Ibiza: The Ibiza real estate market is going very well

- Our article on the Balearic Islands: Everything you ever wanted to know about the Balearic Islands

- Check the monthly weather statistics for Ibiza

- Check some of our experts in our local network in Ibiza: Real estate Lawyers in Ibiza, Property hunters in Ibiza, Architects in Ibiza, How to find a mortgage in Ibiza all assisting you in your language

- Find your local experts in Ibiza within our network, it’s free!

Balearic property prices (blue -3,436€) vs. Spain’s average (orange) from 1995 to March 2025, including annual and quarterly transaction trends.

Las Palmas de Gran Canaria property prices: €1,976/m², +7.9% yr/yr

Real estate transactions for Las Palmas: 14,498 +7%

Have a look at our interactive Las Palmas real estate price chart:

Real estate prices in Gran Canaria came back to the national average of real estate prices in Spain.

Have a look at the property hunting in Las Palmas de Gran Canaria realized by our local property hunter:- Property hunting in Tenerife for a Holiday apartment.

- Tenerife property hunting: a Case study of property for sale in Tenerife

Here are our other resources on Las Palmas de Gran Canaria:

- Our article on Las Palmas de Gran Canaria: Gran Canaria, the tropical gem of Spain

- Our article on the Canary Islands: Everything you ever wanted to know about the Canary Islands

- Check the monthly weather statistics for Las Palmas de Gran Canaria

- Check some of our experts in our local network in Las Palmas de Gran Canaria: Real estate Lawyers in Las Palmas de Gran Canaria, Property hunters in Las Palmas de Gran Canaria, Architects in Las Palmas de Gran Canaria, How to find a mortgage in Las Palmas de Gran Canaria all assisting you in your language

- Find your local experts in Las Palmas de Gran Canaria within our network, it’s free!

Spain real estate price evolution, with Las Palmas property prices at 1,976€ in March 2025 versus Spain’s average of 2,033€

Madrid real estate prices: €3,477 /m², +11.5% yr/yr

Property transactions for Madrid: 89,252 +17%

Have a look at our interactive Madrid real estate price chart:

Real estate prices in Madrid are leading the charge, 75% higher than the national average. They are now 13% above the pre-crisis levels of 2008. Considering the number of transactions, Madrid and Barcelona are the two strongest markets.

Have a look at the property hunting in Madrid realized by our local property hunter:

- A Madrid buy-to-let property investment.

- Americans are buying real estate in Madrid at a 20% discount!

- Remote working from your Madrid’s pied-à-Terre?

- Madrid property hunting: a Case study

Here are our other resources on Madrid:

- Our articles on Madrid: Real estate foreign investors are discovering Madrid, Madrid on the top 3 list of European Cities to invest in

- Check the monthly weather statistics for Madrid

- Check our Citytrip postcards on Madrid

- Check some of our experts in our local network in Madrid: Real estate Lawyers in Madrid, Property hunters in Madrid, Architects in Madrid, How to find a mortgage in Madrid all assisting you in your language

- Find your local experts in Madrid within our network, it’s free!

Madrid property prices rising to 3,477€ from 1995 to March 2025, compared to Spain real estate prices at 2,033€.

Málaga property prices: €2,614 /m², +12.3% yr/yr

Property transactions for Málaga: 39,187 +12%

Have a look at our Málaga real estate price chart:

Real estate prices in Málaga are approximately 30% higher than the national average and more than 10% above their peak reached in 2007, before the crisis.

Looking for a property hunter in Málaga? Here are our property hunters in Málaga. Here is one of the last property-hunting deals done by them:

Here are our other resources on Málaga:

- Our articles on Málaga: Malaga: an emerging city to buy second homes, Malaga is always a place for your dream house

- Our article on the Costa del Sol: Everything you ever wanted to know about the Costa del Sol.

- Check the monthly weather statistics for Málaga

- Check our Citytrip ePostcards on Málaga

- Check some of our experts in our local network in Málaga: Real estate Lawyers in Málaga, Property hunters in Málaga, Architects in Málaga, How to find a mortgage in Málaga all assisting you in your language

- Find your local experts in Málaga within our network, it’s free!

Evolution of real estate prices in Malaga and Spain from 1995 to March 2025, showing Malaga at 2,614€ and Spain at 2,033€

Palma de Mallorca real estate prices/Balearic Islands: €3,436 /m², +13.2% yr/yr

Real estate transactions for the Balearic Islands: 15,904 +6%

Have a look at our Mallorca real estate price chart:

Real Estate prices in Mallorca are 40% higher than the national average and are at all-time highs.

Looking for a property hunter in Mallorca? Here are our property hunters in Mallorca.

Here are our other resources on Mallorca:

- Our article on Palma de Mallorca: Mallorca, a paradise in the middle of the Mediterranean

- Our article on the Balearic Islands: Everything you ever wanted to know about the Balearic Islands

- Check the monthly weather statistics for Mallorca

- Check some of our experts in our local network in Palma de Mallorca: Real estate Lawyers in Palma de Mallorca, Property hunters in Palma de Mallorca, Architects in Palma de Mallorca, How to find a mortgage in Palma de Mallorca all assisting you in your language

- Find your local experts in Palma de Mallorca within our network, it’s free!

Balearic property prices (blue) vs. Spain’s average (orange) from 1995 to March 2025

Murcia property prices: €1,174 /m², +6.5% yr/yr

Property transactions for the property market in Murcia: 28,189 +15%

Have a look at our Murcia real estate price chart:

Real estate prices in Murcia are about 40% below the national average. and nearly 40% below their 2007 pre-crisis levels.

Have a look at the property hunting in Murcia realized by our local property hunter:

- Murcia property hunting: 3 case studies

Here are our other resources on Murcia:

- Our article on Murcia: Murcia, a good city to make a property investment

- Check out our infographic on Costa Calida with all the nice activities you can enjoy there.

- Check the monthly weather statistics for Murcia

- Check some of our experts in our local network in Murcia: Real estate Lawyers in Murcia, Property hunters in Murcia, Architects in Murcia, How to find a mortgage in Murcia all assisting you in your language

- Find your local experts in Murcia within our network, it’s free!

Property prices in Spain and Murcia from 1995 to March 2025, with yearly and quarterly transaction figures shown; Murcia price is 1,174€.

Santa Cruz Tenerife property prices: €1,957/m², +12% yr/yr

Real estate transactions for Santa Cruz de Tenerife: 12,860 +5%

Have a look at our Tenerife real estate price chart:

Real estate prices in Tenerife have rebounded nicely, returning close to the national average. As of early 2025, property prices in Tenerife are 11% higher than they were in 2007. The weather is more stable during the winter months, but yes, your flight is a little bit longer.

Have a look at the property hunting in Tenerife realized by our local property hunter:

- Property hunting in Tenerife for a Holiday apartment.

- Tenerife property hunting: a Case study of property for sale in Tenerife

Here are our other resources on Tenerife:

- Our article on Tenerife: Have a look at the property market in Tenerife

- Our article on the Canary Islands: Everything you ever wanted to know about the Canary Islands

- Check the monthly weather statistics for Tenerife

- Check some of our experts in our local network in Santa Cruz Tenerife: Real estate Lawyers in Santa Cruz Tenerife, Property hunters in Santa Cruz Tenerife, Architects in Santa Cruz Tenerife, How to find a mortgage in Santa Cruz Tenerife all assisting you in your language

- Find your local experts in Santa Cruz Tenerife within our network, it’s free!

Property prices Spain in Tenerife and nationwide from 1995 to March 2025, with Tenerife at 1,957€ and Spain at 2,033€

Seville real estate prices: €1,631 /m², +5.2% yr/yr

Transactions for the real estate market in Sevilla are strong: 26,568 +22%

Have a look at our Seville real estate price chart:

Real estate prices in Sevilla are 25% lower than the national average and 10% below their 2007 levels.

- Our article on Sevilla: Discover the charm of the south and invest in Seville

- Check out our infographic on the Costa de la Luz, which includes all the activities available there.

- Check the monthly weather statistics for Seville

- Check some of our experts in our local network in Seville: Real estate Lawyers in Seville, Property hunters in Seville, Architects in Seville, How to find a mortgage in Seville all assisting you in your language

- Find your local experts in Seville within our network, it’s free!

Spain real estate price evolution from 1995 to March 2025: Seville at 1,631€ vs. Spain at 2,033€

Valencia property prices: €1,625 /m², +12.1% yr/yr

Real estate transactions for the property market in Valencia: 41,967 +7%

Have a look at our Valencia real estate price chart:

Real estate prices in Valencia are approximately 25% lower than the national average and have returned to their peak levels reached in 2007. At the same time, it is the third city in Spain in terms of inhabitants! A bargain to check quickly?

- Take a look at the feedback from our real estate city trip to Valencia in April 2018.

- Our article on Valencia: Valencia, the third biggest city in Spain, is a centre of interest for foreigners

- Our article on the Costa de Valencia: Everything you ever wanted to know about the Costa de Valencia

- Check the monthly weather statistics for Valencia

- Check some of our experts in our local network in Valencia: Real estate Lawyers in Valencia, Property hunters in Valencia, Architects in Valencia, How to find a mortgage in Valencia all assisting you in your language

- Find your local experts in Valencia within our network, it’s free!

Spain’s real estate price evolution from 1995 to March 2025: Valencia property prices at € 1,625, Spain at € 2,033

Valladolid real estate prices: €1,391 /m², +5.8% yr/yr

Property transactions for Valladolid: 7,731 +21%

Have a look at our Valladolid real estate price chart:

Real estate prices in Valladolid are more than 30% below national averages and 20% below 2007 pre-crisis levels.

- Our article on Valladolid: Valladolid is getting more open to outside investors

- Check the monthly weather statistics for Valladolid

- Check some of our experts in our local network in Valladolid: Real estate Lawyers in Valladolid, Property hunters in Valladolid, Architects in Valladolid, How to find a mortgage in Valladolid all assisting you in your language

- Find your local experts in Valladolid within our network, it’s free!

Valladolid and property prices in Spain per square meter from 1995 to March 2025, with transaction volume as bars. Valladolid price labeled at 1,391€.

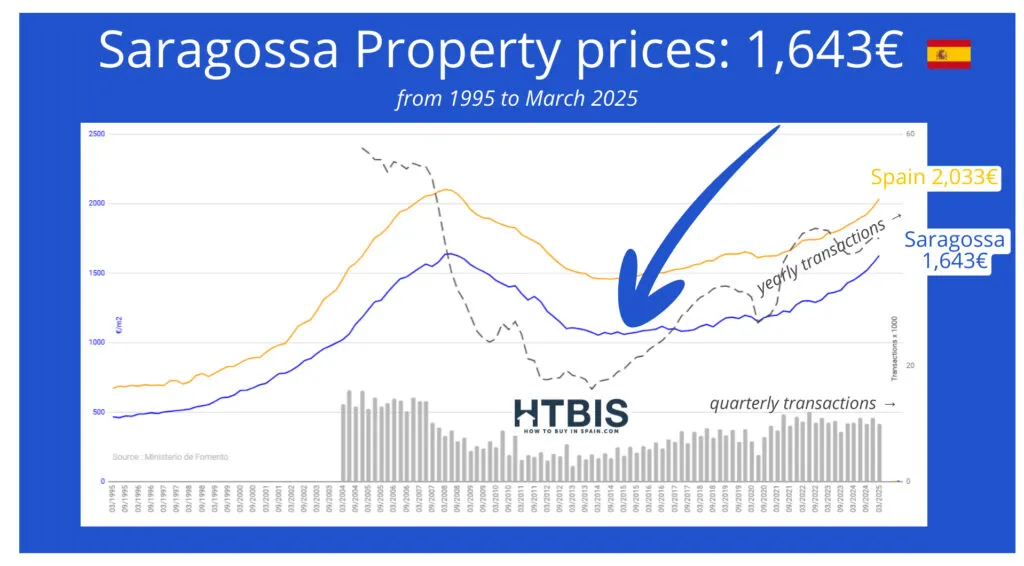

Zaragossa property prices: €1,643 /m², +11.8% yr/yr

Property transactions for Saragossa: 13,640 +15%

Have a look at our Saragossa real estate price chart:

Zaragoza real estate prices are approximately 20% lower than the national average and 30% under their previous peak levels reached in 2007.

- Our article on Zaragoza: Zaragoza Real estate market in 2017

- Check the monthly weather statistics for Zaragoza

- Check some of our experts in our local network in Zaragoza: Real estate Lawyers in Zaragoza, Property hunters in Zaragoza, Architects in Zaragoza, How to find a mortgage in Zaragoza all assisting you in your language

- Find your local experts in Zaragoza within our network, it’s free!

Saragossa and Spain real estate prices from 1995 to March 2025, with transaction volumes shown as bars; Saragossa price is 1,643€ and Spain is 2,033€

Source: Ministerio de Fomento

Please have a look at the resources we have written about other Spanish Cities.

Bilbao

- Our article on Bilbao: Bilbao, the new awakening of the city

- Check the monthly weather statistics for Bilbao

- Check some of our experts in our local network in Bilbao: Real estate Lawyers in Bilbao, Property hunters in Bilbao, Architects in Bilbao, How to find a mortgage in Bilbao all assisting you in your language

- Find your local experts in Bilbao within our network, it’s free!

Sitges

- Our article on Sitges: Sitges, a commitment to tranquillity near Barcelona

- Our article on the Costa de Barcelona: Everything you ever wanted to know about the Costa de Barcelona

- Check the monthly weather statistics for Sitges (Barcelona)

- Check our Citytrip ePostcards on Barcelona

- Check some of our experts in our local network in Sitges: Real estate Lawyers in Sitges, Property hunters in Sitges, Architects in Sitges, How to find a mortgage in Sitges all assisting you in your language

- Find your local experts in Sitges within our network, it’s free!

Don’t know where to start your property search? Start with Our ultimate 2025 guide to buying your property in Spain.

And Where are foreigners buying real estate in Spain? What price do they pay? How active are they?

Find our detailed maps and articles on the Spanish Costas here.

Get your insights right to your mailbox? Register for our weekly newsletter.

Looking for an expert in Spain? Ask us directly!

Senior analyst and strategist at HTBIS

Check the whole HTBIS team here

FAQ

Are property prices in Spain falling?

After the Covid period, where prices stayed stable to negative, real estate prices in Spain recovered and are at 2,033€ per square meter in Spain end of March 2025.

Is now a good time to buy a Spanish property?

The important thing with Spain real estate is that the market is not red hot as in many countries in the world in 2025. Housing is not too expensive at 2,033€ per square meter in Spain as of the end of March 2025. If you compare those to international cities and take into account the quality of life and the cost of living, prices are not expensive.

What is the best place to live in Spain?

You have many choices. The first question to ask yourself: city or countryside? The second one is the proximity to the beaches. And as a foreigner, proximity to the airport is one of the main questions. Don't miss our full guide to searching for your ideal property in Spain. Of course, Madrid, Barcelona, Valencia, and Malaga are some of the most loved cities in Spain.

Can you buy property in Spain without being a resident?

Yes, not a problem. We do have lawyers in our network of local partners to assist you with all the paperwork.